If you adopt cryptocurrencies early, you may remember the era of manual portfolio management when traders entered data into spreadsheets. It was very easy at that time. There wasn’t much to do other than buy and sell on a single crypto blockchain. Portfolio management did not require a lot of time and effort.

However, developers have followed this call and are now seeing a new generation of portfolio trackers to meet market demand, especially for the Defi protocol. Not all dApps are the same, and many offer different capabilities for different trading purposes.

List of Top 5 Non-Custody DeFi Dashboards

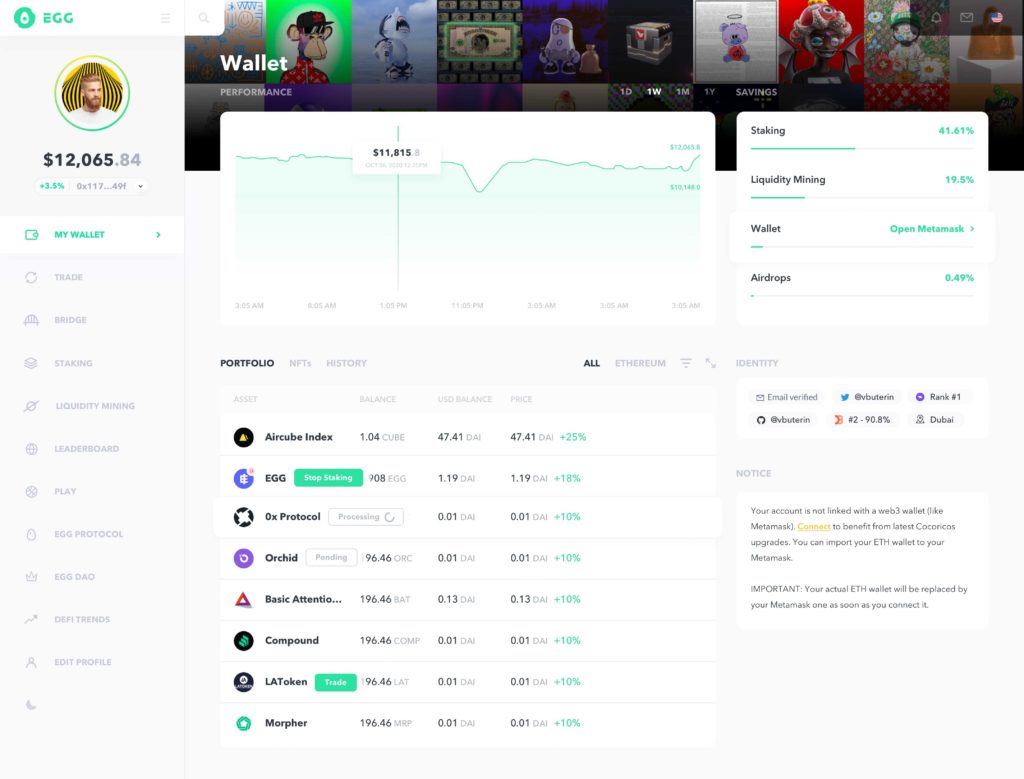

1. EGG Protocol

EGG (Effective Aggregator) is a one-stop DeFi dashboard that does not only aggregate the best Web3 applications. It also bridges blockchains together and integrates fiat ramps to enable an environment that is understandable and usable by anyone.

Each application has its own user interface and prerequisites, which requires more adaptation time and therefore slows down access to information.

Your DeFi dashboard is carefully designed to offer the best of decentralized applications within a single interface. Track, explore, trade, and farm, all from the same place.

Opportunities are sorted intelligently through massive data processing and an alerts system can be set up to give important insights that keep customers up to date. The process appears underwater so that anyone, no matter his experience, can finally be able to manage their

cryptocurrencies in a decentralized, fair, and professional manner.

On EGG Protocol you can track multiple wallets on 14 chains and 157 protocols. You can also trade crypto to crypto and fiat to crypto, provide liquidity, stake, bridge, and many more.

With EGG.FI’s DeFi wallet explorer, users can simply explore NFTs on multiple chains or search blockchain domains and explore the user’s assets and much more.

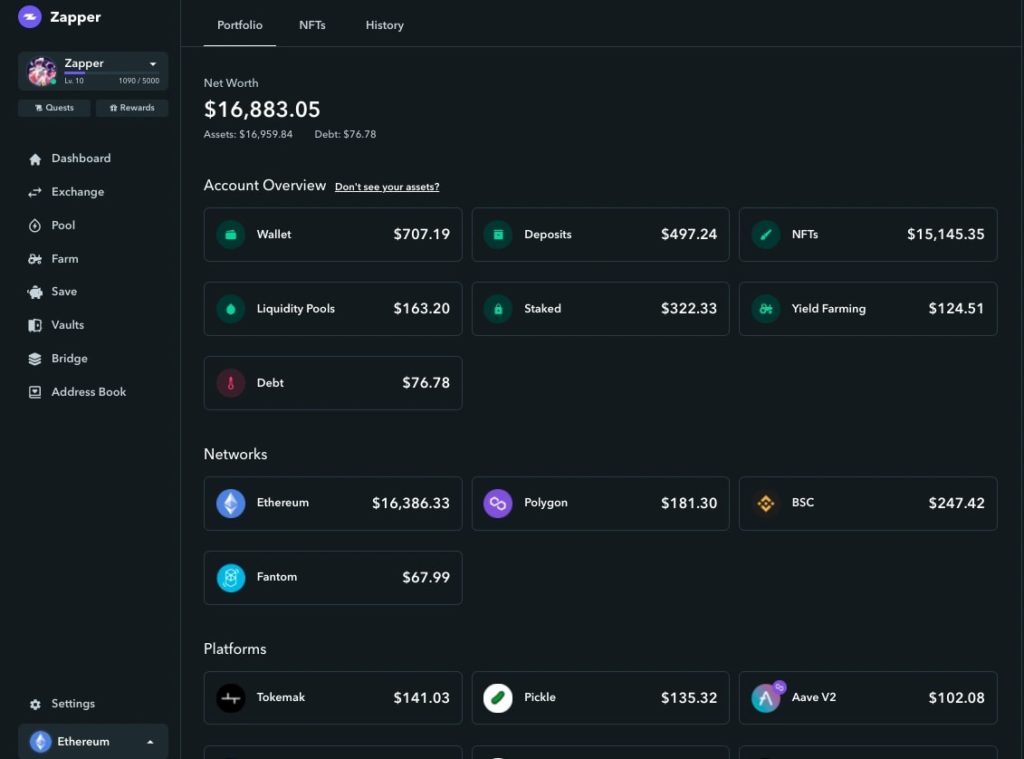

2. Zapper

Zapper is a web3 asset management platform. Its mission is to make web3 accessible and user-friendly. They are working towards this mission as follows:

- It provides a DeFi dashboard that allows users to track and share over 3000 digital assets.

- Integrating logs into dashboards helps builders and developers across web3 reach as many users as possible.

- Creating and sharing educational resources with Zapper will help newcomers understand the complexity of cryptocurrencies and Web3.

Their main product is the Zapper DeFi dashboard. From the dashboard, users can easily see all their digital investments and adjust their portfolios. Their dashboard allows users to exchange assets, provide liquidity to various pools, stake tokens, deposit assets to generate passive income, and wallets for colleagues, peers, and public figures. The latest trends in web3 allow users to easily change their investment strategies by investigating and tracking.

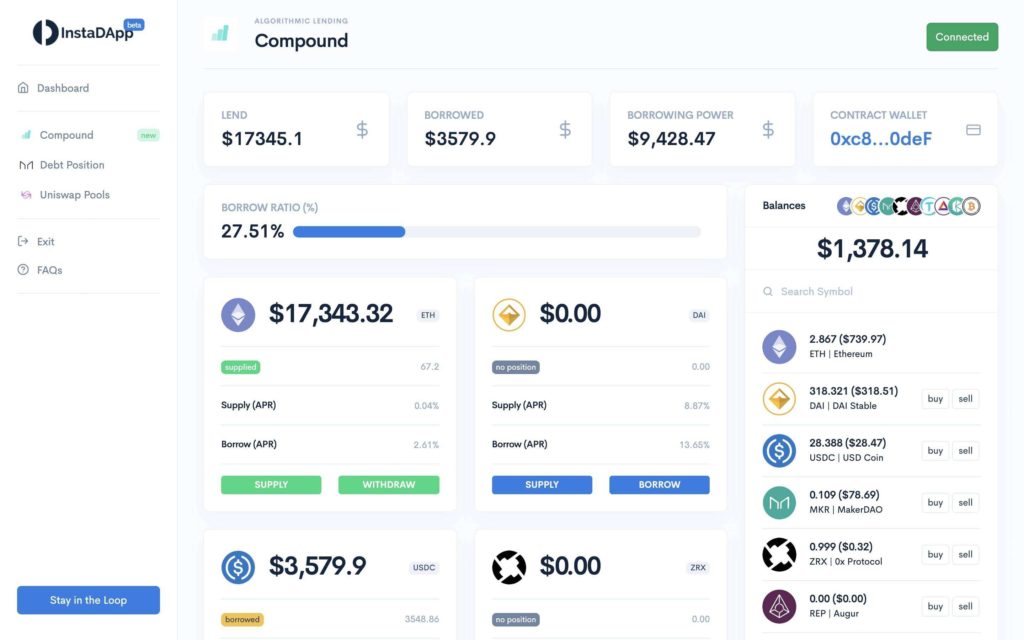

3. Instadapp

Instadapp is a decentralized application that acts as a bridge connecting multiple different protocols on the distributed web. This means that Instadapp integrates different dApps into a single application and manages all of their functionality.

Projects that can be managed by this application include Compound and Uniswap. Instead of switching protocols, you can manage everything from Instagram’s user-friendly interface.

Ultimately, Instadapp provides an interface that allows people to interact with multiple different dApps on a single platform. This means helping users get the most out of DeFi’s potential and making life easier for all. By integrating all these different logs into one dashboard, you can achieve a much better customer experience.

In addition, all data from the Instadapp is public and the application does not contain the user’s assets. This allows users to take advantage of both. The security benefits of decentralization with a centralized asset management platform that provides a better user experience for consumers.

By connecting multiple different dApps using smart contracts, users can manage features such as:

- Lending

- Borrowing

- Swapping

- Leveraging

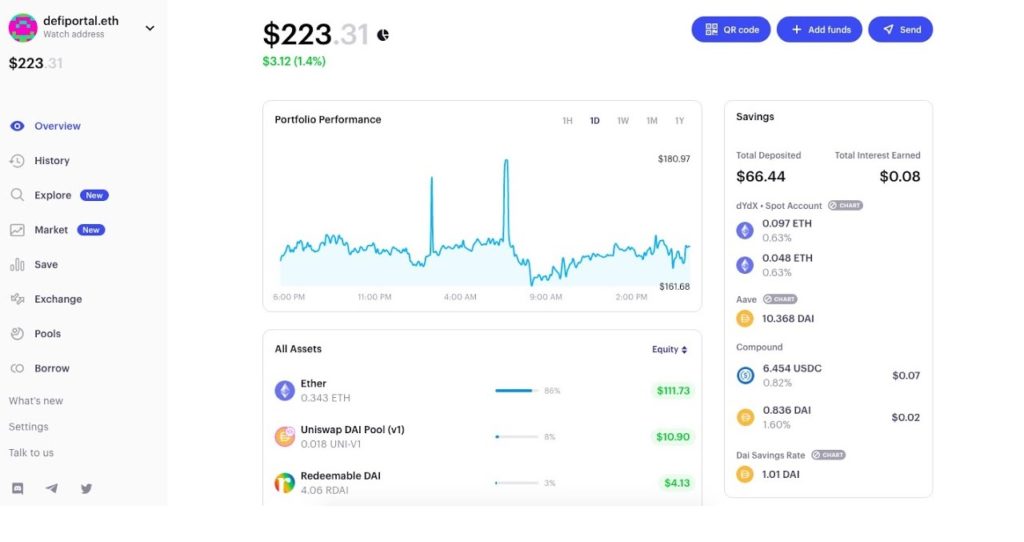

4. Zerion

Zerion is an unmanaged DeFi dashboard designed for simplicity, clarity, and ease of use. In the ocean of competitors, Zelion stands out for its clean, crisp user interface and a minimally invasive approach.

Think of Zerion as a dashboard for your DeFi portfolio. At a glance, you can see in detail your balance, transaction history, savings, and investments. Its minimally invasive approach means that you can use many of Zerion’s features without granting access to your funds. This is a very important feature as DeFi hacks occur on a regular basis.

It is difficult to keep track of all token and DeFi transactions, regardless of whether you use Metamask or Etherscan.

Wallets display simple transactions and balances nicely, but most DeFi

wallets today are not yet aware of complex interactions such as B. Provide liquidity to Uniswap, stake SNX, or open MakerDAO Vault.

Zerion is providing a 360-degree view so you can explore your DeFi portfolio. You can see everything from your balance history, interest earned, vaults, and unpaid loans.

5. Apeboard

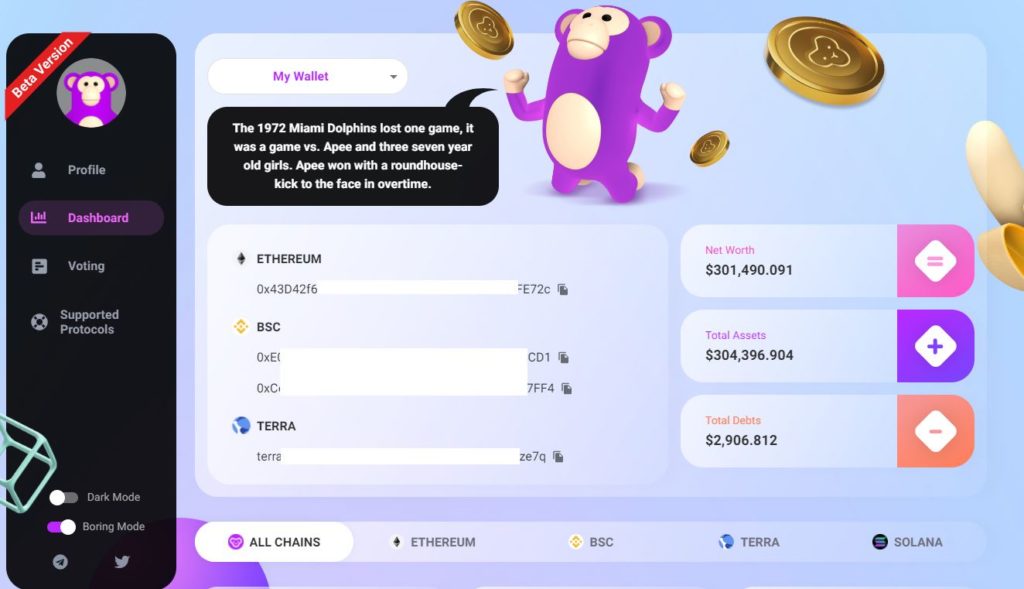

The Ape Board is a cross-chained DeFi dashboard similar to Zelion and Zapper that allows you to monitor your portfolio balances and other balances across the DeFi protocol.

Ape Board supports various chains including ETH, BSC, Terra, MATIC, SOL, and Binance Exchange. Within these blockchains, over 77 protocols are supported. For example, Ethereum`s Aave, Compound, SushiSwap, and Uniswap are supported.

Tracking your portfolio is very easy and you don’t need to log in. Simply enter your address and ApeBoard will track and view all your DeFi activity across multiple chains.

ApeBoard presents your net worth in currency and classifies the total amount of remuneration you can claim by total assets and total liabilities. You can also switch blockchains and view them all at once. You can also track portfolio exposure across multiple cryptocurrencies to see which protocol holds the token.

You can search for tokens or see a list of liquidity pools to invest in. Clicking the APE button will take you to the protocol farm page.

Ape Board has a comprehensive and growing set of integrations across DeFi and it`s one of the recommended places to monitor protocol balances if you are participating in multiple farms across multiple blockchains.

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of EGG Finance. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中文 (中国)

中文 (中国) Русский

Русский Português

Português Deutsch

Deutsch