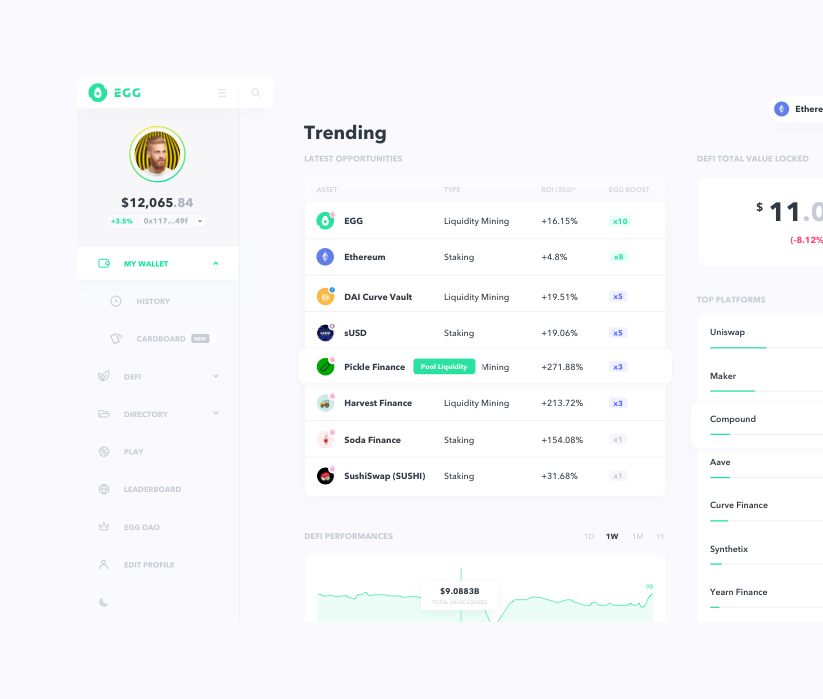

The Easiest Way to Mine Liquidity

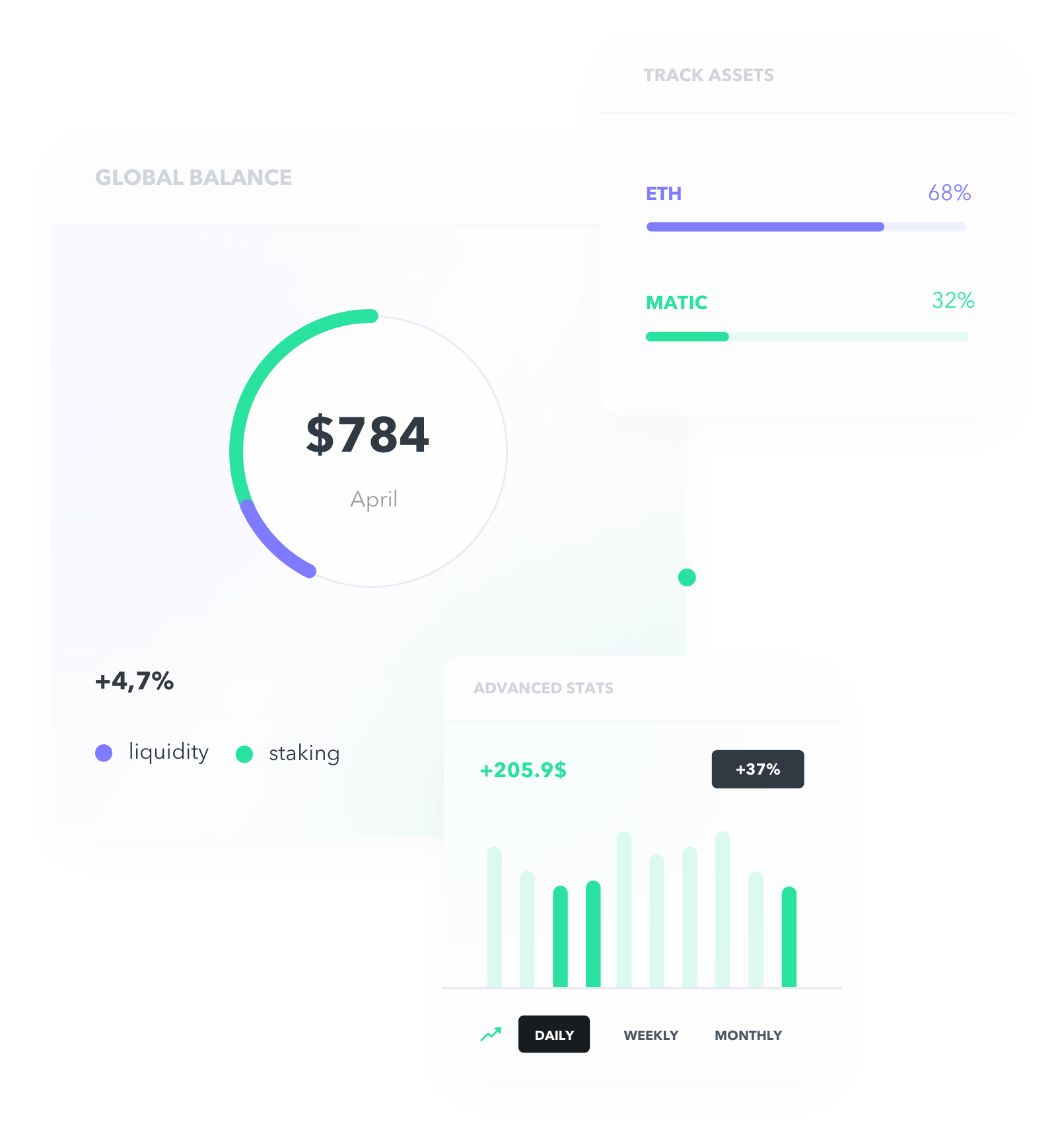

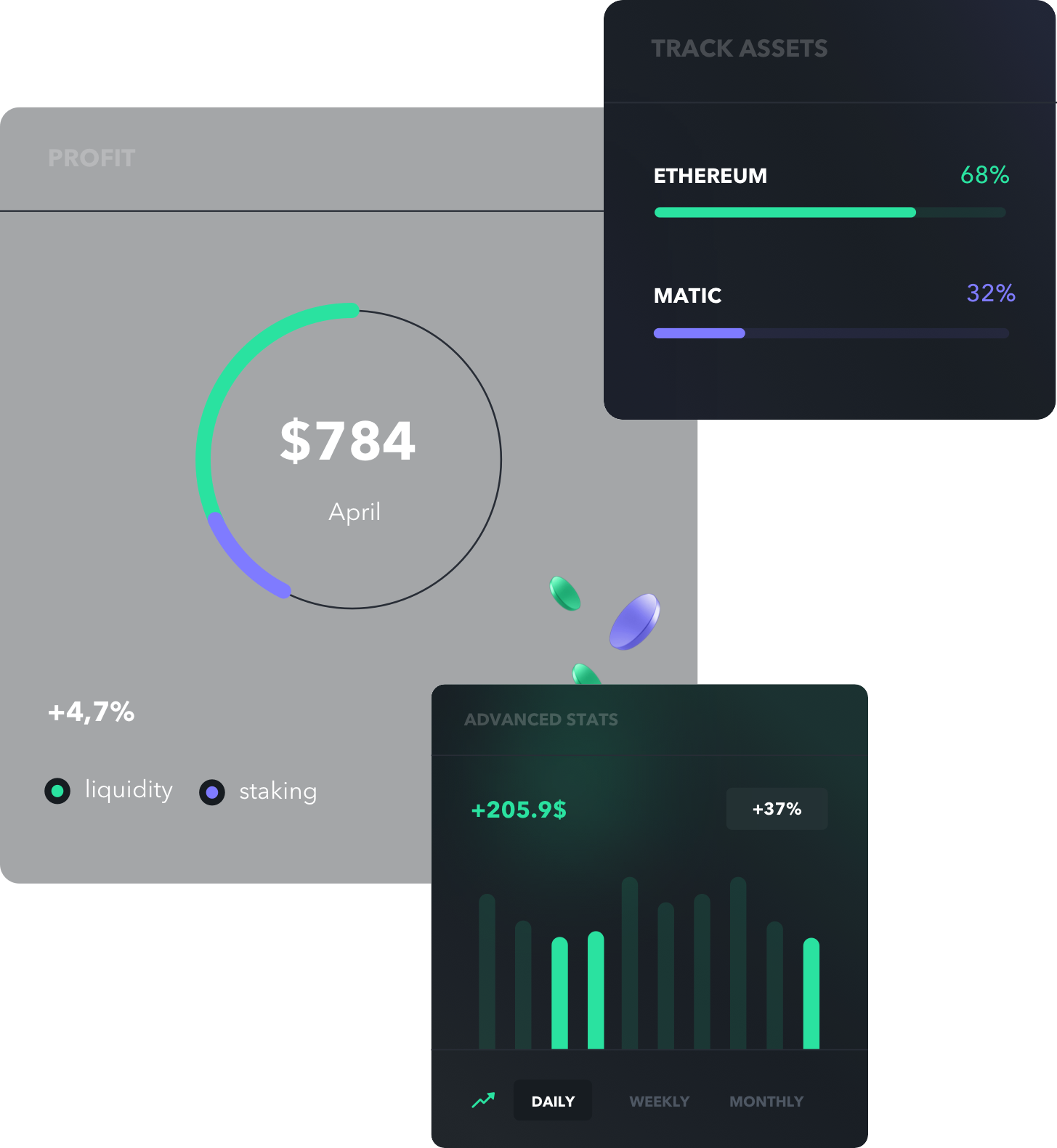

Efficiently perform DeFi liquidity mining from our list of the best available liquidity pools. No need for technical knowledge or extra fees. With single asset liquidity mining, the added asset gets split 50/50 before being deposited into the DEX. Simply connect your web3 digital wallet to EGG.FI and find the pool that suits you best.

Mine Now

Automated Liquidity Price Slippage Rebalancing

Find the best route with the lowest costs to keep the slippage to a minimum. EGG strives to make sure that the trade’s expected price is not too different from the price at which the trade is executed.

Disclaimer: Despite some slight slippage possibly happening during rebalancing, EGG.FI does not retain fees from small trades.

Mine NowDeFi Liquidity Mining In 3 Easy Steps

Swap any digital asset you want through our user-friendly DeFi Aggregate platform with 3 easy steps:

Connect to the EGG platform with your web3 digital wallets, such as MetaMask and Fortmatic. You can also connect your wallet with an EGG email account or a separate email with Magic Wallet. Keep in mind that each wallet requires you to login and authorize your wallet differently. Once it is connected, select liquidity mining from the list on the left.

With your wallet connected, you can select one of the liquidity pairs on the liquidity mining tab. Currently, only Ethereum liquidity pools are available, but we will soon support liquidity mining on other blockchains. Choose a pair and “INVEST.” Then, you will see a window where you can choose which token and how much to deposit, and you can also see how it will be allocated in the pool.

On the window of your chosen pair, you can see the pool share and the possible rewards you can gain from the pool. Once you have written the amount you want to allocate, you can click confirm. Depending on the wallet, the confirmation may take some time. But please do not refresh the page, or the process will restart.

DeFi Liquidity Mining Platform FAQs

If you have more questions, contact us

ContactWhat is Liquidity Mining?

How does Liquidity Mining Work?

What is Coin Control when Providing Liquidity Mining?

What are the Risks of Providing Liquidity Mining?

-Impermanent loss;

-Price volatility of the assets you’ve put in the liquidity pool;

-Rug-pull or similar scam exit.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中国

中国 Русский

Русский Português

Português Deutsch

Deutsch