Today's Stakeable Crypto APYs by Market Cap

The global crypto market cap is $2.76 t, a -1.6% increase over the last day. Read More

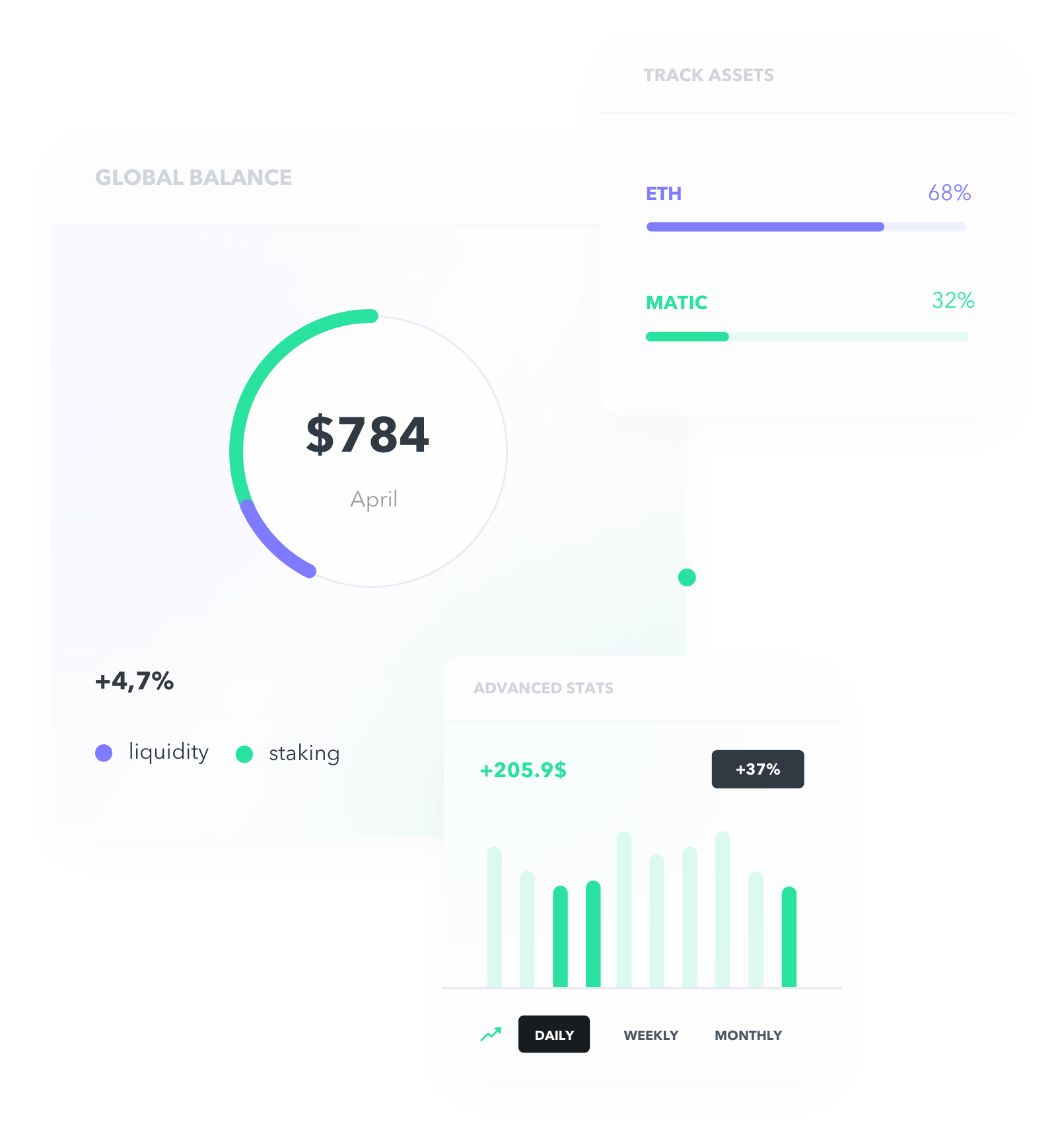

Earn Profitable Staking

Rewards with EGG

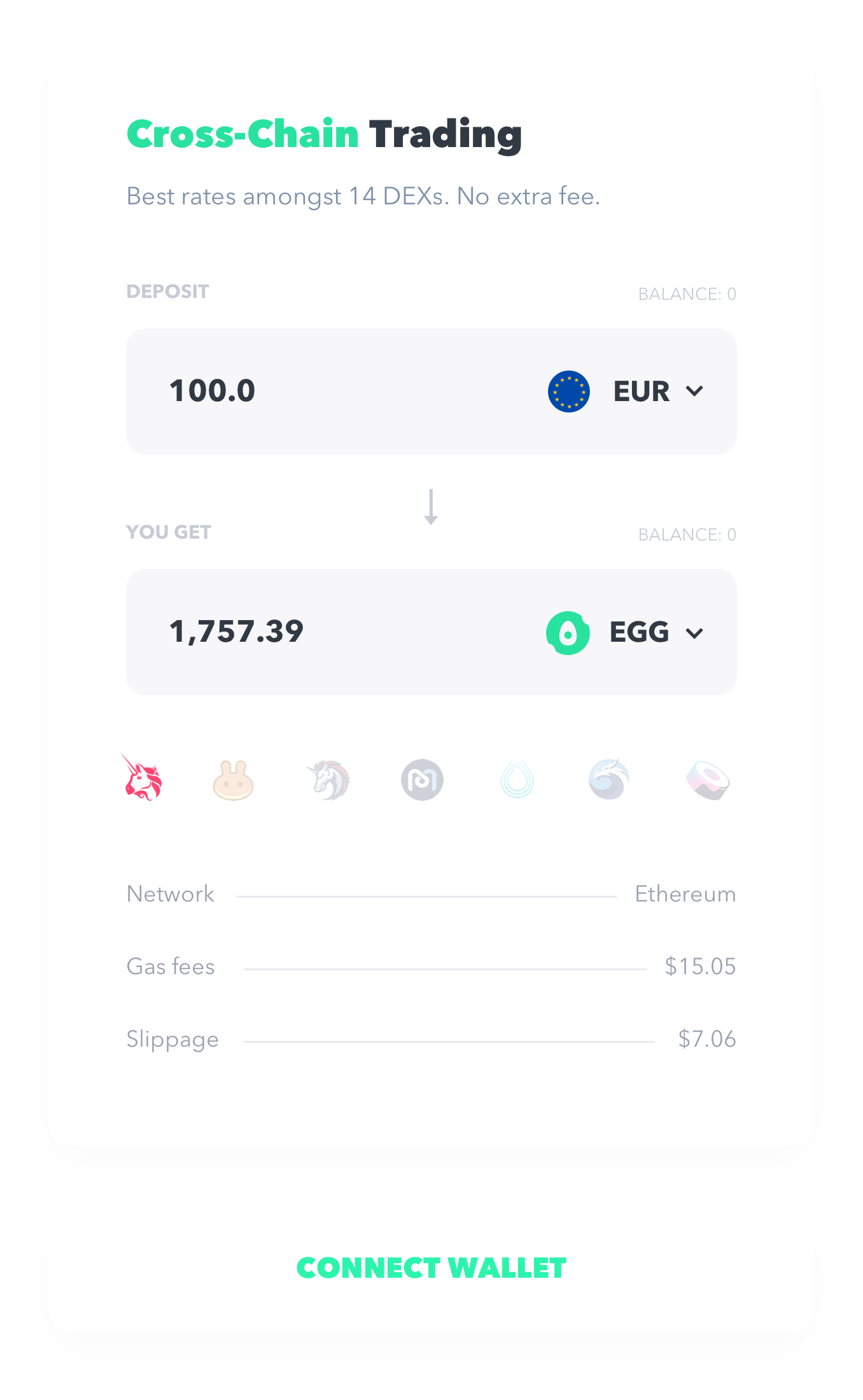

Lock up your crypto earnings on EGG with low-entry fees for a defined period of time to the high APYs and crypto staking rewards - % APY + % EGG rewards !!!

$ 111BN

crypto trading per day

$ 17.1BN

transactions through digital payments

$ 2.16T

worth crypto market cap, 8th largest economy globally

Easy to use &

Secure Staking

In the crypto world, it is difficult to choose between various validators. Based on a more efficient analysis method, EGG connects you with the best-in-class validators that provide high-uptime, secure staking with advanced monitoring and support.

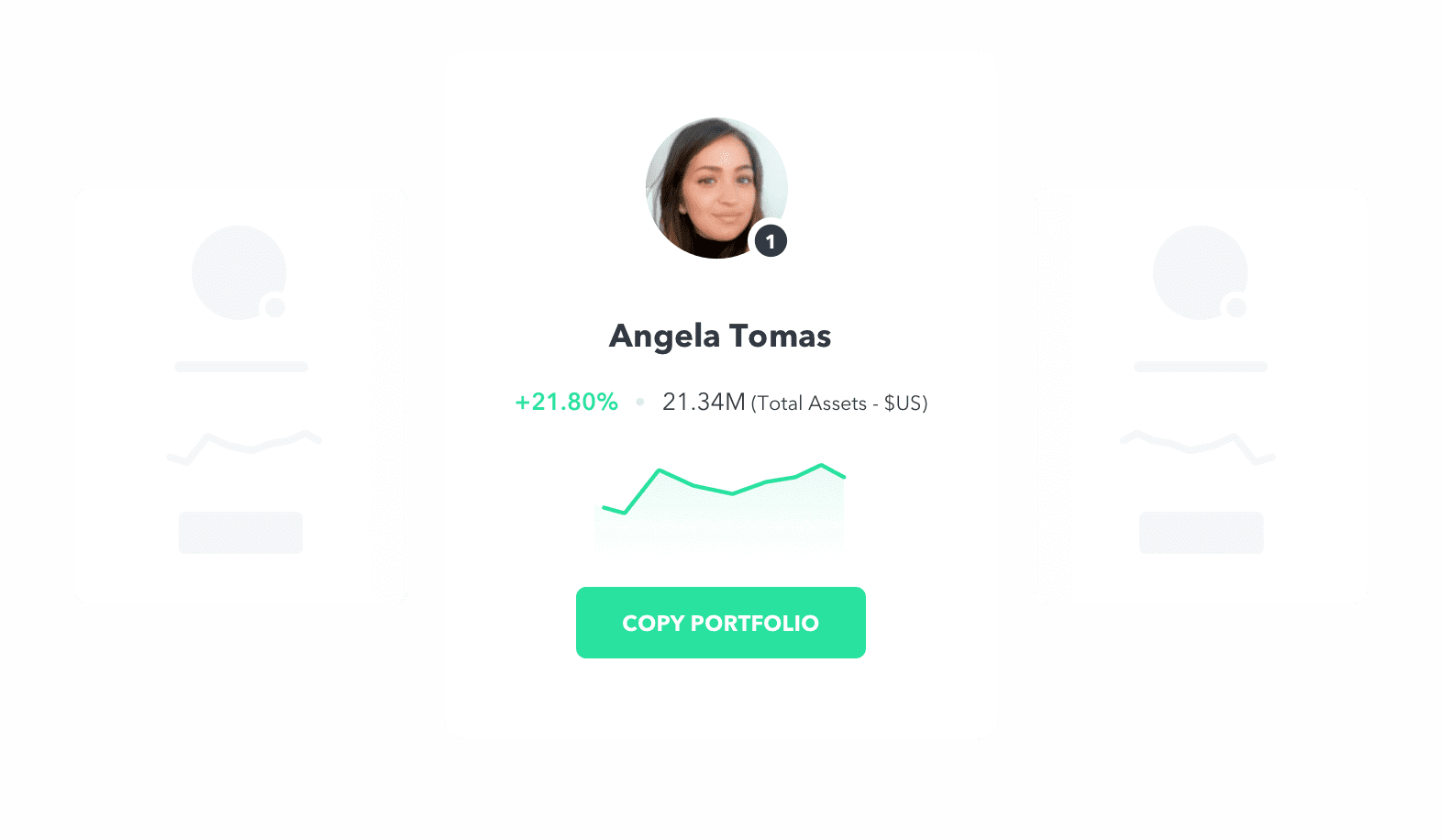

Crypto Staking just became much Easier

Staking crypto on your own is hard for any user. Stake as little as $10 in crypto coins and start earning passive income. The more assets you hold, the more income you generate. Stake now the top ranked assets that generate the most rewards in 3 easy steps:

Connect Your Wallet To Start Crypto Staking

Click on the green connect wallet button and select Metamask, Fortmatic, etc. Keep in mind that you will have to install the software on your computer. Once you’ve installed the software, you’ll get a popup on the right corner of the page, which is a signature request to give you permission to trade after confirmation. Once you’ve connected your wallet, you can go back to the staking platform.

Proceed To Staking Your Prefered Tokens

Now that the wallet is connected, you can select the token you want to stake, enter the amount of the token you want to stake, and click on the Stake button to continue. Now you’ll see a popup, which will require you to confirm the staking. Wait a few seconds for the next popup which will be for the staking transaction confirmation.

Earn Staking Rewards

During the confirmation process, make sure not to log out or refresh the page, because you might have to start all over again. Wait a few seconds for final submission and, afterward, check the tokens on your profile.

Staking News

Don’t miss out on the latest cryptocurrency staking news and articles.

Cryptocurrency Staking FAQs

If you have more questions, contact us

What is Staking?

How does Staking work?

What are the risks of Staking?

Can I Trade assets during Staking period?

Is there a way to avoid expensive fees while Staking?

How are Staking profits paid out?

The Newsletter

Sign up and get awesome notifications.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中国

中国 Русский

Русский Português

Português Deutsch

Deutsch