Table of Contents

The long-awaited Ethereum Merge is coming up in a month, and recent developments on the possibility of a fork in the ETH PoW chain have emerged in anticipation of the event. But in what specific ways does that manifest itself? Continue reading to find out.

Goerli, the third and final Ethereum testnet, has successfully merged to a proof-of-stake (PoS) consensus mechanism, which shows that it is very much on track. The most recent developments show that it is very much on track.

However, there has been growing speculation about Ethereum’s move to proof-of-stake (PoS) and the future of the proof-of-work (PoW) chain. These rumors have been fueled in large part by Justin Sun, the founder of Tron, and Chandler Guo, a prominent Ethereum miner.

This brings forth the question:

What will happen if, after the Merge, there are two distinct Ethereum chains, one based on proof-of-work and the other on proof-of-stake?

It’s possible that you’re wondering: aren’t there already two Ethereum chains, one for ETH and one for ETC? Therefore, would this make a total of three?

What Will Happen During the Merge?

The Merge has been discussed in numerous articles on multiple occasions, so here is a summary of the upcoming Ethereum Merge:

- The Merge signifies the changeover from proof-of-work to proof-of-stake in Ethereum’s consensus algorithm. At the time of this writing, the date that had been planned for its completion has been moved up to September 15.

- The current mainnet (PoW) and the Beacon Chain (PoS) will be merged into the new Ethereum blockchain when it is launched (PoS). It will have a consensus layer, which will synchronize the chain state across the network, as well as an execution layer, which will process the interactions between smart contracts.

- There will be no increase in throughput, nor will there be any reduction in gas prices.

- Only between six and twelve months after the Merge will staked ETH become withdrawable.

- Ethereum’s issuance rate will decrease by 90%.

- By moving away from Proof-of-Work validation, Ethereum will become “more friendly to the environment.” Traders like Arthur Hayes believe that this is one factor that could entice institutions to buy and stake ETH, which would likely drive up the price of the cryptocurrency.

There are additional nuances to the switch, but the information presented here covers the essentials of what you should be aware of. You can find additional information in our in-depth look at Ethereum 2.0; however, we feel obligated to point out that the Ethereum Foundation has since abandoned the terminology “Ethereum 2.0.” You can read our in-depth look at Ethereum 2.0 here.

What Will Happen To ETH Miners?

Even though miners of Ethereum now have few options available to them, one of those options is to switch to other proof-of-work coins that are mined using graphics processing units (GPUs). Examples of such coins include Ethereum Classic and Ravencoin. Ethereum Classic was described by Vitalik as “totally a fine chain.”

Machine learning or rendering farms are two examples of other GPU-intensive activities that miners could put their hardware to use for instead of mining. However, one possibility has recently gained traction, and that is the prospect of a proof-of-work Ethereum fork, which will make it possible for miners to carry on with their operations.

What Is ETH PoW?

Considering that Ethereum is almost certain to adopt PoS, one might wonder why ETHPoW has suddenly gained popularity and what exactly it entails.

Consider the individuals who are not likely to be enthusiastic about the transition to the new consensus mechanism. Someone who actually enjoys proof-of-work and has invested significantly large sums of money into it is one possibility.

Someone like…miners.

The Ethereum mining industry, which is estimated to be worth $19 billion, as well as mining rigs, will become obsolete as a result of the Merge, according to Messari. Miners of Ethereum are interested in finding alternative uses for their mining hardware, which is only natural. Vitalik Buterin made the suggestion that they could switch to Ethereum Classic, which is the “original” version of Ethereum. After the DAO Hack, the current chain split off from the original chain.

However, that is not the strategy that the miners intend to use. For the time being. In its place, EthereumPoW is planned to evolve into a hard fork of the existing chain, which will then transition into proof-of-stake:

Consequently, EthereumPoW would be the fork of a fork if this were the case. The existence of three separate Ethereum chains adds further complexity to the situation. However, EthereumPoW comes with a number of tangibly problematic side effects.

What Are the Possible Drawbacks of a Split in the Ethereum Proof-of-Work Chain?

A blockchain can be divided into two distinct chains through the use of a hard fork. In this specific scenario, ETH Proof of Work and ETH (on proof-of-stake). Additionally, all of the tokens, NFTs, and native coins that are currently on the chain will be duplicated when the fork occurs. Even the liquidity on decentralized applications (DApps) will be replicated. Suppose you have 10 ETH, 10,000 USDC, and a liquidity provider position prior to the fork; after the fork, you will have exactly the same assets on both chains.

Does this mean that we can easily double our net worth by participating in the Ethereum Proof of Work system?

Oh, if only it were that simple.

A network can, of course, be replicated, but the value it provides cannot be. If you make a copy of Wikipedia, you will have access to all of the information, but you will not have access to the people who are actively adding to and editing the information. In a similar manner, a PoW fork of Ethereum will not have the support of the developers and the community, and more importantly, it will not have the support of DApps and stablecoin issuers who will honor their commitments.

To put it another way, the value of your stablecoin based on ETH PoW will immediately decrease to zero. Your long positions on money markets will instantly lose all of their available liquidity in order to accommodate ETHPoW. (the coin). Oracles will support decentralized finance on Ethereum, rather than Ethereum proof-of-work. DeFi on Ethereum PoW is already doomed before it even begins.

In addition, the Proof-of-Work system used by Ethereum has two very minor flaws.

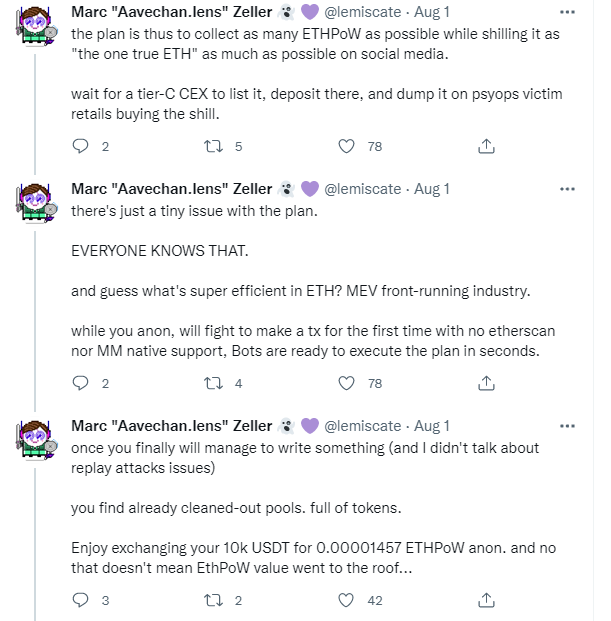

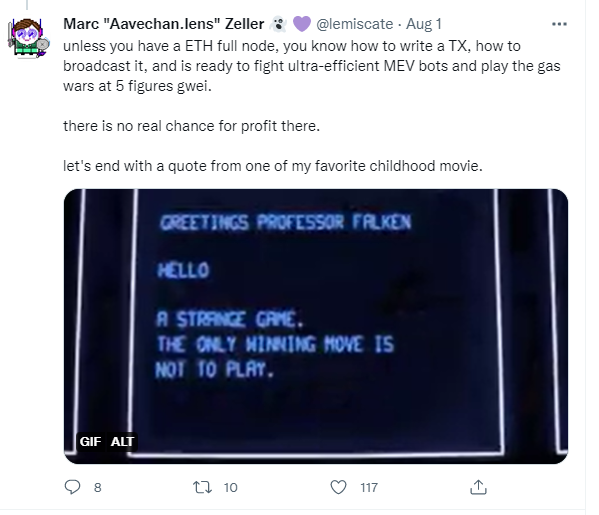

To begin, ETHPoW (the coin) will, at the very least initially, keep some of its value. Consider the fork to be the equivalent of ETH holders receiving an airdrop of ETHPoW. On the other hand, bots have the potential to and most likely will extract all of the value that is contained within the ecosystem by draining all of the liquidity pools for ETHPoW.

In what has been called a malicious plot to dump on unwary retail (we’ve seen that one before), some miners are supporting ETHPoW:

Sure enough, the ETHPoW coin will soon be listed on BitMEX.

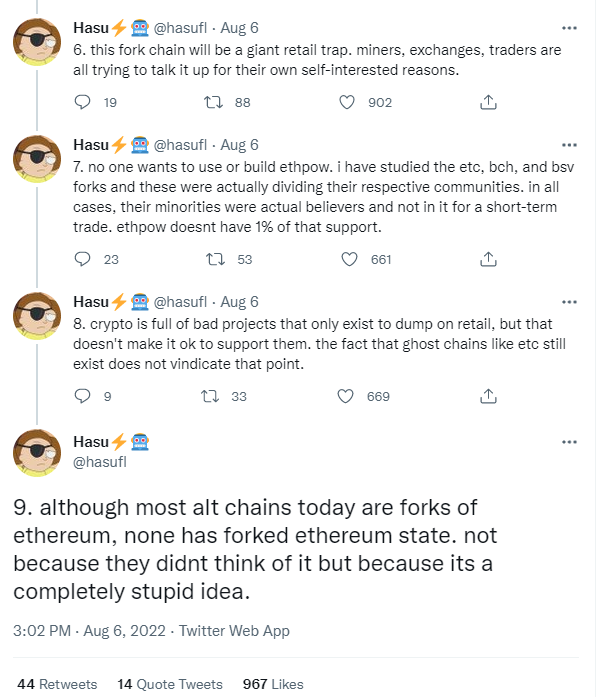

As a second point, the technique highlights (yet again) the dark side of cryptography. That of self-interest and utilizing uninformed users for exit liquidity:

The hardest element, forking the chain again to avoid the built-in difficulty bomb that will render mining impractical over time, would still need to be overcome for EthereumPoW.

Can You Profit From ETH PoW?

Yes. And no.

After the fork, all ETH holders will have access to the same number of ETHPoW. At the time of writing, ETHPoW was trading at about $69 on Poloniex (supported by Justin Sun), Gate.io, MEXC, DigiFinex, and CoinW.

Despite the potential pleasantness of this airdrop, you should prepare for a significant amount of dumping after the merge is complete. There’s no way anyone would buy Ethereum only to obtain the “airdrop.”

However, since clearing the liquidity pools of the liquidity is a game best left to the experts and not the typical DeFi user, the answer is also no.

An another chapter has been added to the never-ending story of Ethereum’s move to PoS. Since The Merge is still a month away, this probably won’t be the final one.

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of EGG Finance. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中文 (中国)

中文 (中国) Русский

Русский Português

Português Deutsch

Deutsch