A lot of DeFi tokens are still trying to find their baseline despite Bitcoin’s massive upwards trend.

The current value locked in the DeFi projects is around 1 billion USD which is a significant overall drop and some researchers think that the DeFi token prices have diverged since September.

Even though the token prices are still in red, the locked value is still near its all-time highs, while some of the DeFi projects have lost 50% from their previous highs.

It’s clear that the cryptocurrency investors have become cautious of high supply inflation for DeFi tokens that are still trying to find the real and not hyped price baseline. Some of the highest supply inflation projects are losing the most of their value, such as: Compound, Balancer, MCDEX, Curve, and mStable, the drop on the following projects is around 60% since September.

It’s no wonder that the stablecoins are rising in value, this proves that cryptocurrency investors have shifted from high-risk DeFi projects into assets that offer lower yearly return.

After the COMP token success, many of the copycat projects with their own governance tokens and yield farming pools have been ghosted. The DeFi projects with the biggest inflation rates were ghosted the most.

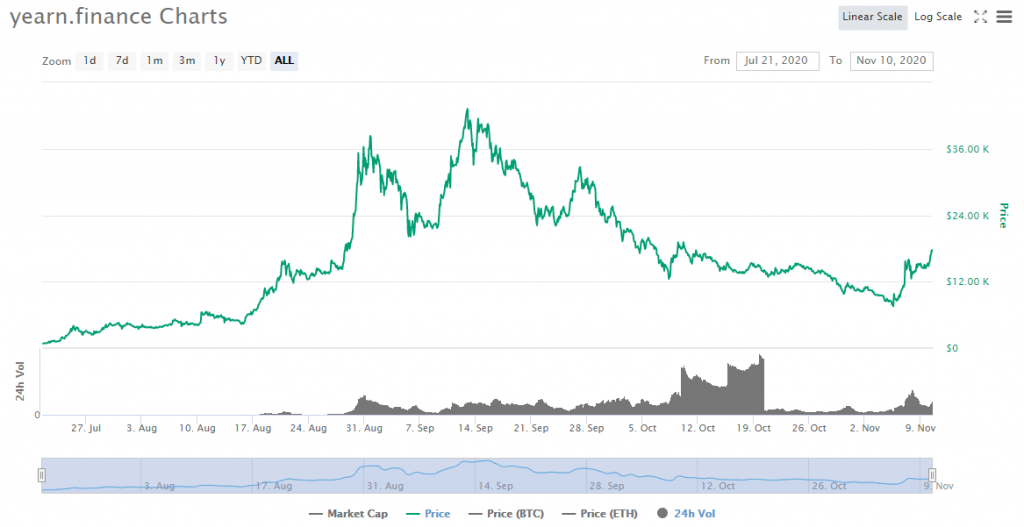

The token that overpassed the Bitcoin price per token, Yearn Finance token has lost almost 70% of its price, from its all time-high of 44,000$ it went to ~17,000$ which is a significant drop since September 13.

But this only proves that the market capitalization of the DeFi projects is very small, currently it’s less than 2% and the volatility is almost impossible to stop. Despite the current price crash of most of the DeFi tokens, cryptocurrency investors are continuedly supporting the DeFi’s vision of a truly decentralized market where third parties are excluded. This only leaves a room for growth and new all time-highs once the DeFi market becomes scalable and massively adopted.

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of EGG Finance. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中文 (中国)

中文 (中国) Русский

Русский Português

Português Deutsch

Deutsch