Table of Contents

The success of cryptocurrencies such as Bitcoin and Ethereum attracts scammers. We share six tips on how crypto investors can protect their cryptocurrencies.

“Be your own bank” – is a motto that you hear again and again in the cryptocurrency world. However, there is a small problem, because, in contrast to Volksbank, Sparkasse, etc., nobody is liable for cryptocurrencies if the “private bank” falls victim to theft.

Analysts consider it likely that custodial service providers will also play a major role for small investors in the future. In this case, a third party then takes on the task of crypto protection – similar to how banks do with fiat money today. However, this area of the crypto industry is still in its infancy. Crypto investors are therefore responsible for their cryptocurrency safety. But what do you have to consider here? How can investors protect their cryptocurrencies? Which procedure is recommended?

We provide tips on how to secure cryptocurrency.

Tip #1: Save your Seed Phrase and Private Keys properly

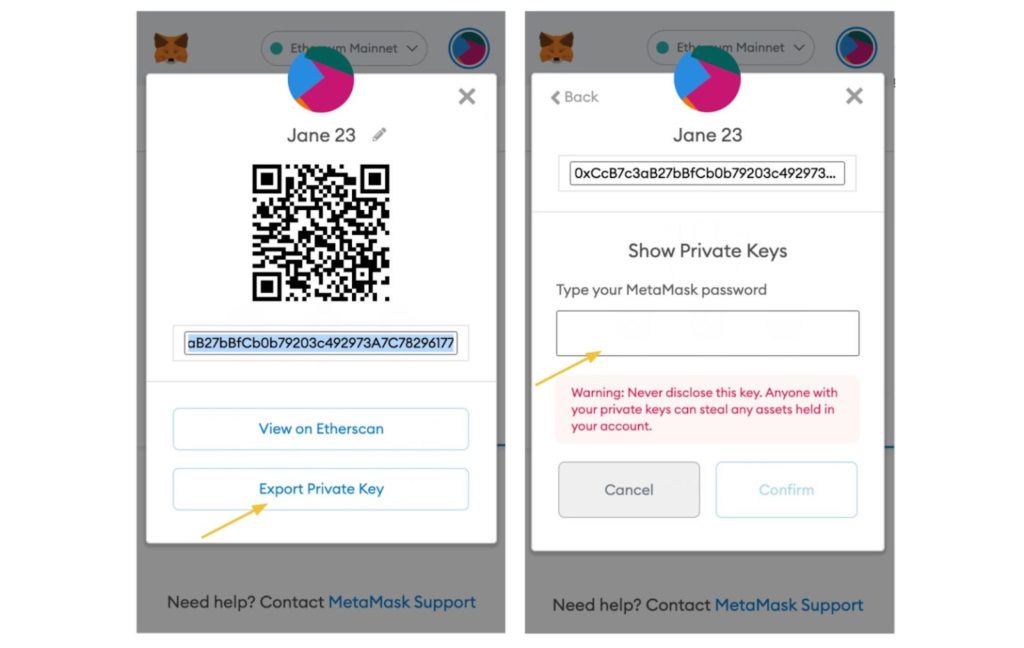

The first tip is for those who are into decentralized wallet providers such as MetaMask, TrustWallet, etc. It is very important to export your seed phrase or private keys from your decentralized wallets and store them properly. The safest way is to make multiple copies of your seed phrase or private keys and to store them in a USB, Hard Disk or write them on a piece of paper and hide it.

This way, if something happens to your computer, then you will be able to easily restore your decentralized wallet address by importing your seed phrase or private key in the wallet app.

Tip #2: Store your Cryptocurrencies on Hardware Wallet

One of the best and most effective cryptocurrency protections for assets like Bitcoin or Ethereum is to use a hardware wallet. This is a small device that stores the aforementioned private keys in a way that makes it almost impossible for hackers to access them.

This is exactly the advantage over conventional software wallets: whenever you use them to send Bitcoin or Ethereum, for example, there is a possible attack vector where hackers can get to the coins, like if the respective computer is infected with malware that reads keyboard entries.

A hardware wallet creates an additional layer of security here since the private keys are firmly anchored in this device. You never leave it – not even for crypto transfers: If you want to make a transfer, you only have to connect the wallet to the computer and confirm the transaction on the device. By using a hardware wallet, hackers have almost no chance of attacking private crypto assets.

The best-known manufacturers of hardware wallets are the French company Ledger and Trezor, but there are also smaller providers. The devices are already available starting from 60 euros. The Ledger Nano S model, for example, has proven itself for beginners.

Tip #3: Move your Cryptocurrencies from Centralized Exchanges

Holding cryptocurrencies on centralized exchanges is not a smart move, because we’ve all witnessed major hacks where users’ funds simply vanished from their accounts.

That’s why our recommendation is to move your tokens from centralized exchanges and keep them on a decentralized wallet or decentralized exchange. You can also leave a small number of tokens on a centralized exchange in case you want to stake your tokens or trade them on a daily/weekly basis.

Tip #4: Beware of Phishing Attacks and Imposters

Crypto investors are often the target of so-called phishing attacks. Attackers try to persuade users to click on a link using fake e-mails, for example. Anything can then hide behind it – the hackers often want to get the seed phrase for the crypto stocks. Or an attempt might be made to access the login data of a crypto exchange. All crypto-related e-mails should therefore be examined closely. Also never enter the seed phrase or the private key online – neither on a website nor in chat rooms or the like!

Tip #5: Use Bookmarks for Crypto Websites

Over and over, scammers create clones of well-known crypto websites that can hardly be distinguished from the originals. The URL often looks identical, differing only by a single letter, for example. Sometimes the cyber criminals even manage to achieve a high Google ranking – or the crooks advertise their “services” with an ad.

It can happen, for example, that a user is looking for a specific crypto exchange and the result is fraudulent plagiarism. There he then unsuspectingly enters his login data for the Exchange – and falls into the trap. However, this can easily be prevented by checking the link address carefully in advance and then creating a bookmark for the respective page. This should be done for all crypto offerings – whether crypto exchanges, coin websites, or DeFi apps.

Tip #6: What Crypto Investors Should Absolutely Avoid

Finally, after the tips, a list of things that crypto investors should absolutely avoid for cryptocurrency protection:

- Don’t do anything crypto-related when you’re distracted or tired. In the crypto sphere, “everything is gone with one click”.

- Never share your seed phrase or private keys with anyone. Not even friends or relatives.

- Do not store seed phrases or private keys in the cloud. Ideally, neither should even be stored on a computer that is connected to the Internet. If this cannot be avoided, the data should definitely be encrypted and password-protected.

- When in doubt, always assume the worst. Be suspicious.

Conclusion

In conclusion, decentralization is good but we have to be very cautious with how we use those decentralized services because one mistake can cost us a fortune. That’s why we came up with these tips so you can avoid making rookie crypto mistakes and have a successful cryptocurrency journey.

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of EGG Finance. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中文 (中国)

中文 (中国) Русский

Русский Português

Português Deutsch

Deutsch