Cryptocurrency users have let their cryptocurrency coins earn them various coins thanks to the DeFi projects to generate them passive income thanks to the Yield Farming trend where cryptocurrency investors can lend crypto, stake their coins or provide liquidity in order to earn a monthly or yearly crypto dividends.

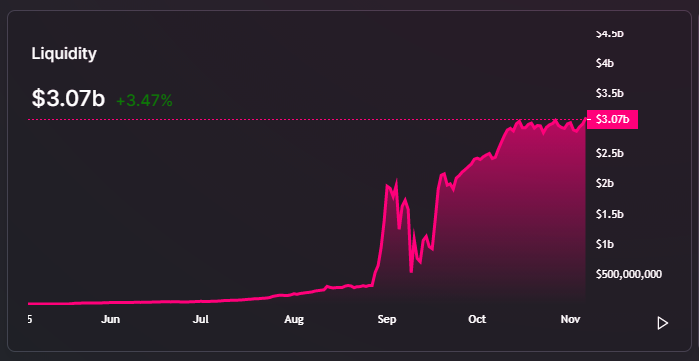

A lot of users think that DeFi is very similar to the ICO boom from 2017 that gained a lot of media attention and blockchain technology adoption. There has been more than 12.5 billion USD locked in the DeFi projects during the current pandemic year.

The ICO hype in 2017 was enormous and much bigger than the current DeFi trend, even though DeFi features have reached more mature market than the ICO’s back in the 2017.

The biggest initiative for the DeFi boom was from the Compound (COMP) back in June 2020 where they contributed for the yield farming trend to increase by offering COMP users to a possibility to borrow and lend the governance tokens. A lot of farmers took out leveraged loans to borrow the COMP tokens with the highest yield, earning very high returns. Few months later this blockchain concept has been replicated by many other Defi projects, open-source projects such as Uniswap, Aave, and MakerDAO.

And then we saw the Sushiswap scandal that shaked the entire cryptocurrency sphere. The founder of Sushiswap successfully converted ~2.5m Sushiswap tokens to Ethereum (ETH). This has left a huge mark that it will be hard for the investors to overpass it.

If we compare DeFi and our current finance system the DeFi is far more risky because of all those exit scam projects, extremely high APY’s, failed projects, etc. and it will be a real challenge for cryptocurrency markets to reach a mature market growth.

On the other hand the DeFi is a very interesting and self governing concept that has a huge potential to replace the current traditional monetary system, hopefully with the ETH 2.0 staking the investors can earn monthly or yearly dividends by putting their Ethereum coins to work and verify transactions for the Ethereum community and by doing that to get rewards from the transaction fees.

Since the first Proof of Work (PoW) project, Bitcoin, ever since then there has been a lot of changes in the cryptocurrency sphere, cryptocurrency users have seen airdrops, ICO’s, IEO’s, STO’s and now they are participating in the emerging brand where they can lend, stake and provide liquidity, the cryptocurrency technology is travelling with the lightning speed.

Once the Ethereum 2.0 release launches, we must wait and hope that the market will attract new cryptocurrency users and will maintain a stable market that will offer good APY’s for investors who used their coins in order to help the network security, improvement and growth and only then we can see a truly scalable and transparent ecosystem capable of attracting mass adoption.

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of EGG Finance. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中文 (中国)

中文 (中国) Русский

Русский Português

Português Deutsch

Deutsch