Table of Contents

In this article, we gonna compare the old traditional finance system using centralized technology, and the modern decentralized finance system built on blockchain technology. You will find out the pros and cons of each system.

Current Traditional Finance System

If we take Western Union, for example, Western Union has become a major player in international money transfer. Western Union now has 550,000 stores around the world and recorded 300 billion euros in transactions in 2017 alone.

However, the strengths that made Western Union a true market leader have gradually turned into drawbacks in an increasingly digital world.

Alternative solutions, such as blockchain technologies, are emerging to meet the new needs of travelers, both individuals, and professionals: money transfers are intended to be more transparent, but also faster and easier to perform online. Here is everything you need to know about Western Union and the alternative solutions to make your choice with all the cards in hand.

What Services Does It Offer to Its Users?

The range of services offered by Western Union is exclusively dedicated to money transfers and is aimed at individuals as well as professionals.

The services offered by Western Union are intended to be as simple as possible. The American brand, therefore, allows you to transfer money from one country to another, but also to follow the progress of your current operations.

These services are obviously accessible from Western Union points of sale, but also within national post offices. Finally, Western Union offers its money transfer services online, on its website as well as on a dedicated mobile application.

Are the Services Reliable?

Western Union’s historical longevity makes it one of the most trusted money transfer solutions. Indeed, the American company offers its services within its own agencies but has also partnered with national players, recognized for their reliability. In France, this is particularly the case with La Poste or the Franprix brand, which can take care of your Western Union transfers.

What Do Users Think?

Western Union services are generally praised for their rigor and reliability, but also for the security of transfers. The brand’s long experience in the money transfer sector thus represents a real pledge of trust for users.

On the other hand, the American brand suffers directly from its model based on a network of physical agencies. It is also not very transparent about the transfer fees, rates, and commissions it applies to its clients’ transactions. It is thus impossible to consult the exchange rates applied by Western Union in real-time, and therefore to know in advance the amount received by the recipient of your transfer.

What Are the Cons of Western Union?

Since Western Union is a centralized authority, it can have a lot of cons for third world countries, here are the most significant cons of the Western Union service:

- High fees for transferring money

- Long waiting time

- Not all countries are supported

- Power to freeze users’ money

The Modern Decentralized Finance System

Decentralized Finance (DeFi) is a new financial technology based on a secure distributed ledger similar to that used in cryptocurrencies. This system deprives banks and financial institutions of control of money, financial products, and financial services.

DeFi 1.0 was the revolutionary technology in the cryptocurrency sphere, but as technology keeps maturing, the DeFi 2.0 is even better, more secure, more rewarding, and faster.

Crypto companies like EGG Protocol, Velas, Polygon, and many more are leading the way, offering DeFi services without any authority and available to anyone with internet access.

What Services Does It Offer to Its Users?

DeFi offers various services, including sending and receiving cryptocurrency assets on multiple networks, lending, borrowing, staking, liquidity mining, bridging, and many more.

Every service that is offered by those DeFi companies is without any authority to prevent transactions and to block users from sending/receiving funds or from participating in various DeFi actions.

Are the Services Reliable?

DeFi services are stored on a public blockchain which makes it more transparent, they are built by using a smart contract where third parties are excluded and the power is given to the people who mine or stake their tokens in order to strengthen the cryptocurrency network.

But since there are no centralized authorities, DeFi users have to be extra cautious when they are operating with their Web3 wallets such as MetaMask, TrustWallet, etc., or when they are connecting their wallets to the exchanges or DeFi protocols.

Since you have the full power and control over your assets, you also share the full responsibility for your cryptocurrency assets. If you lost them, or someone steals them, there is no way to get them back.

What Do Users Think?

The fact that the cryptocurrency trend is growing bigger and bigger, speaks a lot, cryptocurrency users are enjoying no restrictions, they can send funds to anyone, put their assets to work for them, and earn passive income, or they can simply invest them into other coins for a possibility of increasing their USD value over time.

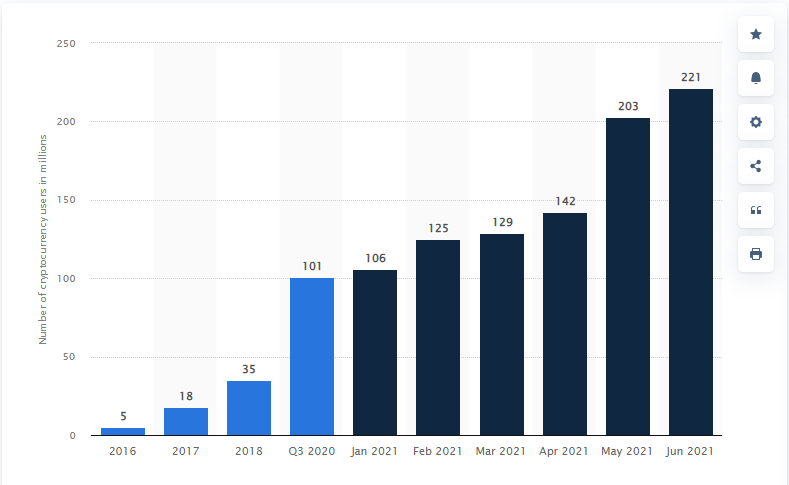

In 2017, there were around 18 million verified cryptocurrency users, and now, there are more than 200 million users.

In the chart below, you will be able to see the verified cryptocurrency users by year.

What Are the Cons of DeFi?

Since DeFi is a new technology, and every technology has a rough start, there are some cons that DeFi should eliminate as the technology continues to evolve. Some of the cons are:

- Smart contracts’ exploits

- Rug-pulls

- Users have no room for errors

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of EGG Finance. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中文 (中国)

中文 (中国) Русский

Русский Português

Português Deutsch

Deutsch