Table of Contents

What DeFi is and why it launched Crypto Spring is explained below.

The story that is certainly the main driver of the rapid rise in prices we have witnessed in recent months began a few years ago when projects were launched that today dominate the crypto market. The fruits of labor are becoming more visible and the first wave of decentralized banking is on the horizon.

The value locked in various DeFi protocols is skyrocketing and breaking all records. Thus, the Ethereum network has been completely saturated in recent months with a large number of transactions and operations that are constantly performed by users and various services around the world.

Transaction fees are constantly rising and often exceed the ever-high prices of Bitcoin transactions. If you send ETH, you will pay an average of $ 2 per transaction, while you will pay several times more for a transfer, conversion or advanced operation with ERC-20 tokens depending on how much you are willing to wait for confirmation.

Why do users pay a staggering $ 7 million a day in fees for transactions and operations on the Ethereum network? The answer is DeFi.

In essence, Decentralized Finance (DeFi) seeks to provide the benefits of traditional blockchain banking services.

Banks – traditional intermediaries between savers and lenders are becoming unnecessary and everyone can be one or the other without the painstaking paperwork, lawyers or notaries. The digitalisation of financial services opens up many innovative opportunities, which we will discuss below.

The Key Differences and Advantages of DeFi Services

- Openness of protocol – anyone can use financial services regardless of age, gender, origin or credit rating.

- Complete control – each user has complete control and ownership of their money.

- Compatibility – easily changing service providers, ie working with more compatible networks and services.

- Availability – all services are available 24 hours a day.

DeFi application

Are you thinking of buying a new TV due to the soon transition to a new frequency of TV signal transmission, do you want a new car or even a house?

The usual consumer mentality is ironing cards or going to the bank for larger purchases, where you go through a nightmare of flushing out all possible personal data in order to determine your credit rating.

Card issuance and loan approval is based on an analysis of your financial profile, which cannot be replicated on the blockchain at this time. Although this is also changing rapidly and there are already ways to get a loan if you have a suitable guarantor.

Therefore, decentralized loans work differently and are mostly useful when you own one currency and want exposure to another. This is usually a case of saving Bitcoin or Ethereum, and you need fiat currency to buy a new TV or car.

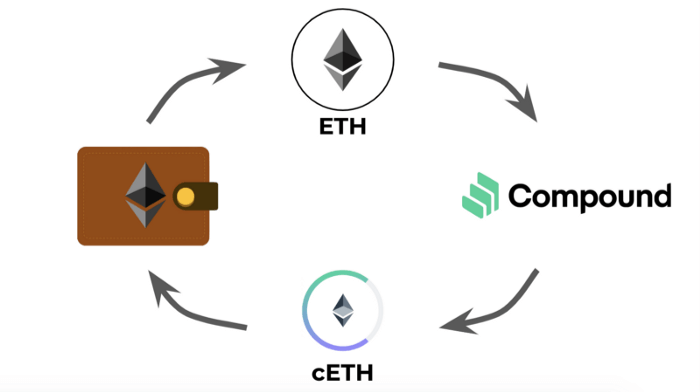

The same goes for exposure to other cryptocurrencies, for example you have Ethereum and want another token without selling ETH. For example, you can place an ETH on Compound and choose a token of your choice instead. In doing so, make sure you have enough collateral so that your ETH is not liquidated in the event of a sudden drop in price.

There is also an interesting innovation devised by the founders of the Aave protocol, the so-called instant loans . The concept is probably the easiest to apply in trading because it allows the use of large positions with certain restrictions.

Namely, a loan can be obtained only on condition that you repay it within the same blockchain transaction. This is very applicable in arbitration. See an example of such a transaction in the image below.

Probably the most popular DeFi instrument is stablecoins, which in various ways try to maintain the value, ie monitor the value of the dollar. The most popular decentralized stablecoin is DAI which maintains value thanks to coverage in ETH coins.

Uniswap Madhouse

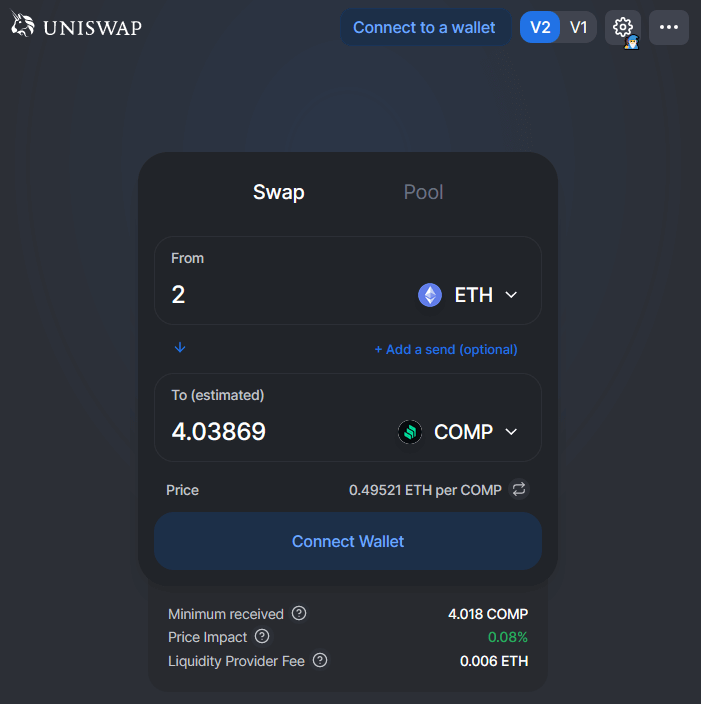

The Ethereum network is currently unable to support true decentralized exchanges that would have all the elements on the blockchain. That is why simplified exchanges with automatic market makers (AMM) have entered the story, which are very easy to use and work on a simple principle.

They are based on liquidity pools located within a smart contract. When exchanging one token for another, the stock exchange makes sure that the product of both pools remains at a constant value. In practice, the only thing you need to pay attention to is the price you will get when buying or selling a particular token, and it depends on the liquidity of the pool.

The most popular AMM exchange with the most liquidity is Uniswap . If you want to test how Uniswap works, you will need Ethereum (ETH). Other AMM exchanges have recently emerged that have more complex pricing mechanisms, but fail to take away a more noticeable piece of the pie from Uniswap.

Farmers – modern miners?

Miners who tirelessly dig and take care of the security of blockchain networks are no longer alone. With the popularization of DeFi services, they have been joined by farmers who earn a return by providing liquidity. All of the above services need liquidity.

In order to be able to exchange ETH for another ERC-20 token on Uniswap and vice versa, someone has to fill the pools with sufficient liquidity. As a reward for taking risks and providing liquidity, a certain percentage of trading fees are received or governance tokens are distributed.

For example, to provide liquidity through the Compound protocol, you will receive a return in the form of a COMP token. Liquidity providers in slang are called farmers, while liquidity shifting with the aim of optimizing and farming as high a yield as possible is called crop rotation.

DeFi interest rates are significantly higher than the negligible yield you will receive in banks – in some situations the yield reaches an incredible 1000% per year. Of course, as the yield increases, so does the risk.

Management Structure

DeFi protocols are managed by investors through governance tokens that are irresistibly reminiscent of equity shares with certain benefits. As a shareholder in a company, you have a voice in choosing the executives who then run the company.

On the other hand, management tokens such as COMP and LEND give you much more control and authority. If you have a majority share of the token you can literally vote to change the smart contract and change the protocol rules.

Differences in relation to centralized institutions lie in the distribution of tokens, regulation, and openness of decentralized protocols. In theory, control tokens should be widespread enough that there are not one or more individuals who have a majority stake in protocol control.

Risk

The use of the DeFi protocol entails certain risks that it is advisable to be aware of. Security risks include omissions in designing smart contracts that skilled hackers can abuse, while economic risk boils down to irresponsible use of the service.

There is also a risk of evil intentions of the founders of a particular project – more and more scams are popping up every day and it is advisable to use only proven projects with a good reputation. When investing in upcoming projects, you must be prepared for extreme volatility and adjust your position accordingly in order to reduce the risk to a level acceptable to you.

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of EGG Finance. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中文 (中国)

中文 (中国) Русский

Русский Português

Português Deutsch

Deutsch