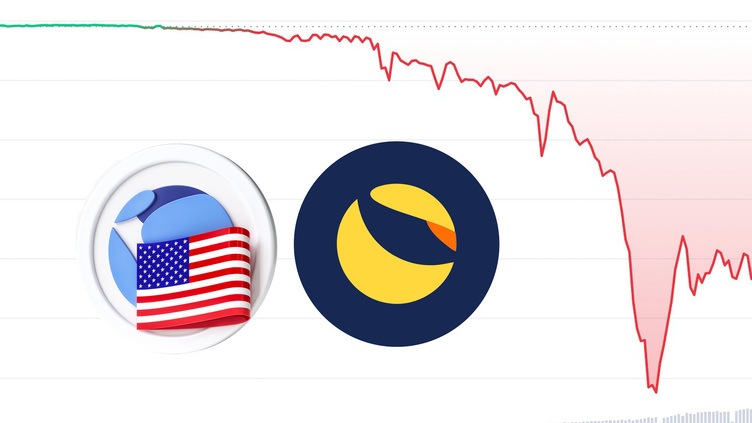

After the court in Seoul issued an arrest warrant for Kwon this week over his alleged role in the collapse of the global crypto market earlier this year, Do Kwon, the creator of the cryptocurrencies Luna and TerraUSD, has become one of the most reviled men in South Korea. In fact, he is considered to be one of the most despised people in the country.

A warrant for Kwon’s arrest was issued by South Korean authorities on Wednesday as a result of the sudden collapse of the cryptocurrency market in May, which caused investors of all sizes to suffer losses totaling in the billions of dollars. Kwon is accused of stock exchange violations as well as fraud. He is the co-founder and CEO of the Terraform Labs cryptocurrency ecosystem.

The crypto industry is still reeling from the devastating financial losses and the spectacular demise of the company that have turned a 30-year-old entrepreneur into arguably the most reviled man in South Korea. These events have caused the digital sector to continue to reverberate. The fact that Kwon is currently on the run is a development that has further exacerbated the scandal.

Even though his whereabouts are unknown, he can still be found active on Twitter. Apologies have been published on his website, and he has even hinted at a successful comeback.

‘The financial guru of a cult’

The authorities in Seoul, on the other hand, have a strong suspicion that he is hiding somewhere in Singapore because Kwon maintains offices in that Asian city-state, and Singapore does not have an extradition treaty with South Korea.

According to the Financial Times, they are considering several different strategies in an effort to coax the engineer out of hiding. Among these strategies is the possibility of revoking the engineer’s passport or requesting that Interpol issue a red alert, both of which would make it more difficult for the fugitive to travel.

Seoul is determined to do everything in its power to bring Kwon to justice because of the magnitude of the financial harm that was largely inflicted upon South Koreans as a result of the collapse of Kwon’s crypto-empires. South Koreans suffered the majority of the losses. Following an investment in Luna or TerraUSD, nearly 200,000 people experienced a loss of capital. Among them was the powerful investment fund known as Hashed, which specialized in digital assets and had losses of $3 billion. Hashed was one of the funds.

Understanding why so many people took a chance on Kwon has a lot to do with the power of social media; he managed to attract a large network of followers. This is one of the main reasons why so many people gambled on Kwon. In an interview with the Financial Times, a South Korean investment adviser by the name of Donghwan Kim described the individual in question as “almost like the financial guru of a cult.”

From Stanford to the ruthless world of cryptocurrencies

Kwon fit the description of a brilliant programmer perfectly. In 2015, at the age of 24, he received a degree in computer engineering from Stanford University. After graduation, he went on to work for two of the most successful companies in Silicon Valley: Microsoft and Apple.

After waiting another three years, he eventually got involved in the cryptocurrency industry by founding TerraUSD and Luna. The coin in question was known as a “stablecoin,” which is a type of cryptocurrency whose value is linked to the cost of another asset and is therefore regarded as “stable.” Tether is the most well-known example of a cryptocurrency that is regarded as a safe haven in the harsh and highly volatile world of bitcoin and ethereum. As a result, these cryptocurrencies are appealing to investors because of their status as safe havens.

Due to the fact that stablecoins are typically pegged to real currencies with low volatility, such as the dollar, their prices almost never experience significant swings. TerraUSD, on the other hand, was not affected in this way because it was indexed to Luna, the other cryptocurrency that Kwon developed. Because of the algorithms developed in-house, the latter was intended to be the component that would keep the system running smoothly.

In the end, those algorithms were unsuccessful, which resulted in a decline for both cryptocurrencies in May. However, when Kwon was working on them in the latter part of the 2010s, algorithmic finesse was not as important as it is today. Kwon’s larger-than-life personality set Luna apart from the other cryptocurrency exchanges, which enabled Luna to attract unsuspecting investors who were interested in cryptocurrencies at the time.

According to a report published by a technology news website called The Verge, “Do Kwon quickly realized that playing this role [the larger-than-life personality] would make it easier to draw attention to himself and his projects.”

‘I don’t argue with the poor’

Kwon spent the majority of his time calling out his rivals and critics on Twitter, which was his preferred platform for doing so. Kwon gave this response in May 2021 in response to a question from an economist about how TerraUSD’s algorithms were being used: “I don’t argue with the poor.” An investor was told that the hundreds of millions of dollars in reserve that Kwon claimed to have to back TerraUSD came “of course from your mother” in response to the investor’s question about where the money came from.

Kwon’s displays of arrogance and odiousness were not limited to just Twitter; they were present elsewhere as well. A few days before the crash of Luna, Kwon made a statement on YouTube predicting that “95% of cryptocurrency projects are going to crash” before adding that this “will be entertaining to watch.”

The New York Times reported that Kwon’s comments gave Luna’s followers the impression that he thought himself to be above the rest of the cryptocurrency pack and was fighting tooth and nail for their interests against a world that didn’t get it.

The New York Times cited cryptocurrency podcast host Brad Nickel, who said, “It’s a cult mentality with a leader who has a larger-than-life personality and at the same time he has a confidence that is very seductive.” “But he’s got it all together.” Nickel was referring to the movement surrounding cryptocurrencies.

The most devoted fans of Kwon even named themselves after Luna and referred to themselves as “Lunatics,” demonstrating how much they admired her. Mike Novogratz, the chief executive officer of the investment fund Galaxy Investment Partners, is one of them, and he even has a tattoo of the moon.

Lives ruined

But things started to go wrong when Do Kwon offered a program that would pay holders of Terra an astronomical 20 percent interest each year. This was his attempt to win over new followers, but it backfired spectacularly.

The popularity of the Luna/Terra ICO skyrocketed, particularly in South Korea, where the offer attracted tens of thousands of investors, both of the large and small-scale variety. The value of the currency plummeted as more and more TerraUSDs were put into circulation, and the algorithmic mechanism that had been designed to stabilize its price was unable to do its job. In just a few short days, the whole thing came crashing down.

Many individual investors on a smaller scale were affected by the fallout.

Ji-hye, a South Korean office worker, told the Financial Times that she was trying to save money regularly but that due to inflation in her country, investments in traditional banks weren’t yielding any returns. Despite my best efforts, my monthly savings were eating away at me due to the high rate of inflation in South Korea. When I first started betting on Luna, her value was skyrocketing, so I risked everything. And in the end, I was unsuccessful in every way.”

According to the Financial Times, the devastation caused by the collapse of the Luna Tower in South Korea was so severe that there was an increase in the number of people searching for information about the Mapo Bridge, which is located in Seoul and is known as one of the most common locations for people to take their own lives. During the summer, the police even increased the number of times they patrolled the area.

It became an embarrassing fiasco for the entirety of the cryptocurrency industry very quickly. Nathalie Janson stated in an interview with France 24 in May that “Terra’s disruptions have accelerated the fall in prices.” As a direct result of the scandal, the global value of cryptocurrencies has decreased by an aggregate amount equal to $40 billion.

Kwon, despite this, did not let it discourage him. Shortly after the resounding failure of his company, he was back at it again, proposing the creation of Luna 2 on the condition that investors would again lend him money. This time, however, he was not successful in getting investors to back him. However, this time around the “lunatics” did not follow their guru’s instructions.

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of EGG Finance. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中文 (中国)

中文 (中国) Русский

Русский Português

Português Deutsch

Deutsch South Korean authorities seek to void

South Korean authorities seek to void  (@stablekwon)

(@stablekwon)