Table of Contents

In this article, we will describe how to track Curve liquidity pools on the Fantom network to earn swap fees and CRV token incentives in this article.

What is Curve?

Curve is a decentralized exchange built for ultra-efficient stablecoin trading and low-risk supplemental fee income for liquidity providers via CRV token awards. Curve allows users to earn fees by trading between stablecoins using a low slippage, low cost algorithm created exclusively for stablecoins. What distinguishes Curve from other DEXs?

Curve employs bonding curves and liquidity pools in a manner similar to other AMMs such as Uniswap. Curve designed their system to be particularly efficient for the swapping of stable assets, such as DAI, USDC, USDT, and others. This is accomplished by employing a different shape curve than Uniswap’s model, which reduces slippage and fees.

What is Fantom?

Fantom is a quick, scalable, and secure smart-contract platform. It is intended to address the shortcomings of previous generation blockchain platforms.

Fantom is open-source, permissionless, and decentralized. It employs a revolutionary aBFT consensus process known as Lachesis, which enables Fantom to be significantly faster and less expensive than prior technologies while remaining exceptionally secure.

What you’ll need to put into liquidity pools in order to Curve on Fantom

- Metamask wallet address

- FTM tokens in your wallet address to cover the gas fee

- Supported tokens to provide as liquidity on Curve

Using your Metamask wallet to connect to the Fantom network

Metamask may be used to interact with Fantom in the same way as it does with the Polygon network. To keep track of your balances, you can utilize an online wallet. It was developed as a Progressive Web App (PWA) to facilitate its rollout across all major platforms.

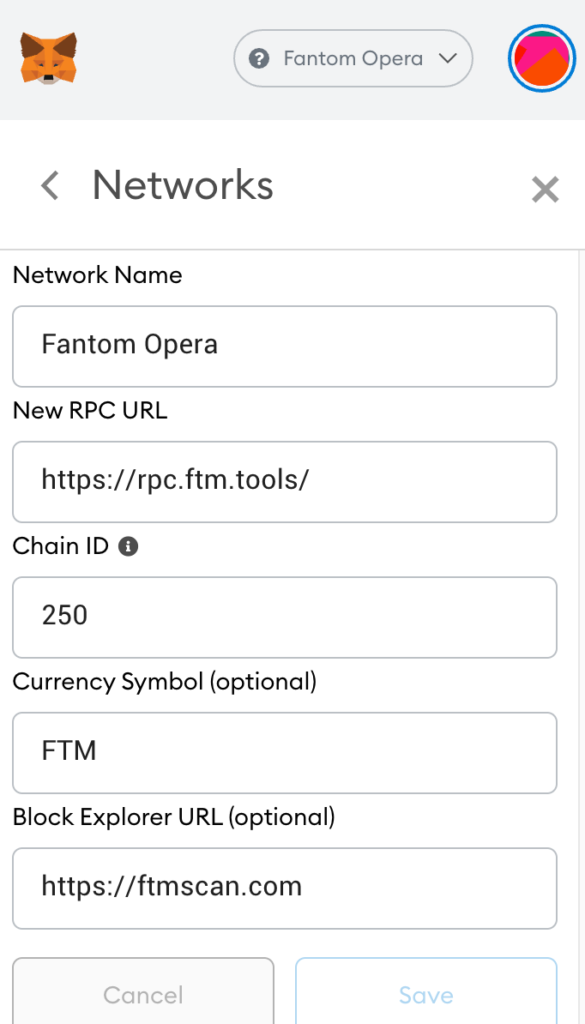

To enable your MetaMask to connect to the Fantom network, click the symbol in the upper right corner and select “Settings.” Once there, navigate to the “Networks” tab, and when you get there, you should see a “Add Network” option where you may enter the following settings:

Here is the list of the details you need to enter in the network field:

- Network Name: Fantom Opera

- New RPC URL: https://rpc.ftm.tools/

- Chain ID: 250

- Currency symbol: FTM

- Block explorer URL: https://ftmscan.com

This procedure adds the Fantom network to the list of available networks from within Metamask. When Metamask is acting strangely or you’re having difficulties getting items to show up, switching networks can be useful.

RESOURCE: Use Chainlist.wtf to gather information on any Metamask-supported chains!

Move funds to the Fantom chain

Moving stablecoins to Fantom is simple and inexpensive; however, moving FTM is more complex. If you don’t have any FTM, you can get some from an FTM faucet.

The APY.vision Bridge tool can help you find pathways between several distinct chains.

Fantom Community Alerts has put up a faucet to offer FTM tokens to new platform users so they have enough FTM to make their first deal. You may locate it on their page under the heading “FTM Faucet.” This is useful if you are just utilizing the stablecoin bridge indicated below and do not have FTM in your wallet for the initial transaction.

Where does the yield come from?

Liquidity providers earn fees on swaps for each trade on Curve.fi, which is why advertised APRs vary greatly based on volume and volatility. It’s crucial to note that because fees are volume-based, daily APRs can often vary dramatically depending on market conditions. Curve, in addition to the trading yield, issues the CRV token as an incentive to liquidity providers.

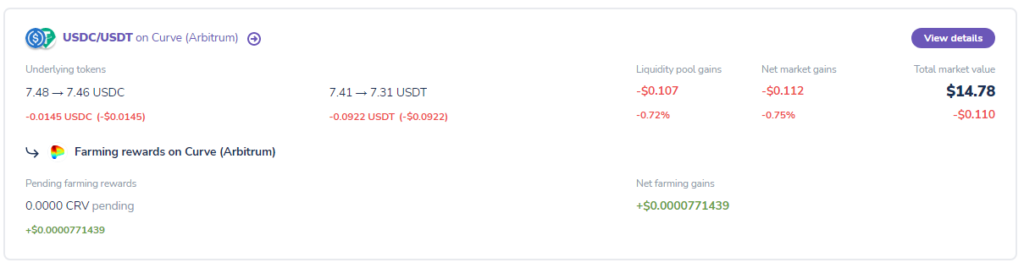

How to Track your Curve Liquidity Pools

First-time APY.vision users should enter their Fantom address in the highlighted box above. On a mobile device or tablet, tap the search symbol and copy their address into the window.

Curve pools are tracked on APY.Vision so that depositors can keep track of their temporary losses as well as their earnings from participating in the pools. APY.Vision will show the change in token balances in the pool as a result of market activity, as well as the CRV farming incentives.

Conclusion

Providing liquidity on Curve is a popular option for crypto investors to make a healthy yield on their stablecoin holdings while avoiding the danger of temporary loss that other types of liquidity pools entail. The returns may not be as appealing as those found in more volatile pools, but risk-averse investors will find Curve to be an appealing home for their stablecoins.

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of EGG Finance. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中文 (中国)

中文 (中国) Русский

Русский Português

Português Deutsch

Deutsch