Table of Contents

The internet was designed to bring people together. That vision, however, was lost somewhere along the way. We’ve handed over our data to centralized figures, allowed big tech to profit from our inventions, and accepted our place in a system that appears to be beyond our control.

This has been the dominant narrative for several decades.

However, a new story is being written in the far reaches of the internet. Amazon, Apple, Facebook, and Google are not the authors. No. You and I are the authors.

Don’t worry if this is new to you; there is still much to be written. To be honest, it has only just begun. Allow this to be your on-ramp to the digital world’s future.

This is the Web3 story.

Web1 – How Did We Get Here?

To truly understand what the internet has become, we must first understand how it got started.

What began as a close-knit network for scientists and scholars has grown into so much more. A series of missteps has followed all of the incredible advances that have been made. The modern web is riddled with problems that can only be fully appreciated by delving into its roots.

Before we dive into Web3, let’s go back in time and see how we got to the internet we know, love, and despise today.

Birth of the Internet

The internet’s origins can be traced back to 1966, when the US Department of Defense began working on a project known as ARPANET.

The Advanced Research Projects Agency Network, or ARPANET, set out to develop a system for remote computer access and communication. ARPANET’s first iteration was a decentralized, peer-to-peer network comprised of a handful of computers at American universities.

To truly comprehend what the internet has become, we must first comprehend how it came to be.

What began as a small group of scientists and scholars has evolved into much more. All of the incredible advances have been followed by a series of blunders. The modern internet is riddled with issues that can only be fully appreciated by delving into its origins.

Before we get into Web3, let’s take a look at how we got to the internet we know, love, and hate today.

The Birth of the Internet

The origins of the internet can be traced back to 1966, when the US Department of Defense began work on a project known as ARPANET.

ARPANET, or the Advanced Research Projects Agency Network, set out to create a system for remote computer access and communication. ARPANET’s first iteration was a decentralized, peer-to-peer network made up of a few computers from American universities.

Web1 Arrives

Even with this advancement in connectivity, the internet remained extremely difficult to use. Although information could be sent from one computer to another, “surfing” the internet’s contents was not yet possible. Even though our villagers could now communicate in the same language, they still had difficulty finding one another. That is, until Tim Berners-Lee stepped in.

Berners-Lee was a computer scientist at CERN with an unusual professional history in 1989. Lee was uniquely qualified to solve this problem that plagued the early internet, having worked with new technologies such as hypertext and computer networking. He recognized how inefficient internet navigation was and, thankfully, proposed a solution.

Lee developed a method of linking internet documents directly to one another by drawing on his knowledge of hypertext and combining it with the new connectivity provided by TCP/IP. It became possible to display information on a public web page rather than simply sending it to someone. The internet could then be navigated by searching for web pages and clicking from page to page, site to site.

This was the start of the world wide web, a method of connecting and accessing information on the internet.

To return to our villagers, the invention of the web linked their individual villages through a solid road system. They could now easily travel from village to village, consuming content and gaining knowledge along the way.

While this was a significant step forward, Web1 still consisted primarily of static web pages with little to no user interaction. As a result, Web1 has earned the moniker “read-only web.” The average Web1 user could only send emails and read information from web pages. However, this was revolutionary at the time.

Handing Over Ownership

The creation of the web, as groundbreaking as it was, came with a catch.

ARPANET’s first iteration was a decentralized, peer-to-peer network. This meant that there were no intermediaries to store web addresses, relay messages, or manage anything else — everything was handled by the network’s individual computers. This worked well when networks were small, but as the web grew in size, it became unmanageable.

To address this, intermediary figures such as the DNS began to enter the new digital world.

The DNS, or domain name system, was designed to handle web address naming and routing. You had to go through them in order to create your own website. Even today, the DNS and its parent organization, ICANN, effectively own the majority of the websites we use. We simply rent domain names from ICANN-authorized registrars such as GoDaddy and Namecheap. But, in the end, we are not acquiring ownership of these domains. This is why websites can be censored, transferred, or completely seized.

That is, we do not own our websites. That is only the beginning.

We are not implying that these organizations are evil, but the introduction of intermediary figures did set a dangerous precedent for the web. Decentralized networks were quickly replaced by closed systems controlled by centralized figures. This was primarily a scaling issue at the time. Because there was insufficient technology to sufficiently scale the peer-to-peer system, centralization became the solution.

Instead of the free and open landscape that its creators envisioned, the web has evolved into a field for harvesting personal data, with centralized behemoths reaping the benefits. This problem has grown in importance as our real lives have become more intertwined with our digital lives.

This brings us to the web as we know it today – Web2.

Web2 – The Web of Today

Web2, also known as the “read-write web,” enabled users to contribute to websites by writing their own content. The internet evolved from a passive platform to a place where people could chat with friends, collaborate with peers, and share original work. Web2 dynamically transformed the static content of Web1. The web became an interactive experience by combining content with applications and introducing better user interfaces.

All of this culminated in the “achievement” that Web2 has come to be known for — social networking.

Social Networking

Beginning with GeoCities in 1994, many websites began to transition from simple information sources to what are now more accurately described as aggregators.

GeoCities, like the many social networks that followed, was largely created by its users. These users, known as homesteaders, created their own pages within GeoCities neighborhoods. Movies, fashion, pets, politics, conspiracy theories, and anime were all covered on these pages. You know, the usual internet nonsense. There were no likes or comments yet, but you could contact the page’s creator via email. Rad!

With users in charge of creating content, web developers began to focus more on improving user experience and incentivizing participation. As thousands of new homesteaders flocked to the site to set up camp, GeoCities real estate became especially valuable. This was due to neither scarcity nor intrinsic value. It was because of the attention. As it turns out, attention is a tremendously valuable asset.

And how do you make money off of attention? Of course, with advertisements.

We Become the Product

Although GeoCities was not the first company or website to monetize attention, they were the first social network to do so. This changed everything, and it cannot be overstated.

This confluence of social media and advertising created a perfect storm that we are still struggling to weather today. Why is this such a big deal? To understand how this relationship works, consider the company that has perfected it: Facebook.

Let’s say you go ahead and create a new Facebook account. You enter your name, age, phone number, and possibly gender. Then you connect with some friends, join a few groups that interest you, and Like some of your favorite brands’ pages.

And with that, you’ve created a virtual version of yourself on Facebook. This virtual version of you is constantly updated as you interact with the platform thanks to the power of AI. Every click, Like, and swipe is tracked and analyzed in order to learn more about you. Algorithms create your virtual identity and sell it to the highest bidder.

Facebook now has billions of these virtual identities and a treasure trove of data that it rents out to advertisers. To be clear, Facebook does not always sell this information. Instead, they use this information to build highly accurate models, which marketers then use to target with ads.

This is a two-edged sword (for us), because this data collection also contributes to Facebook’s ability to make its platform more addictive, attracting more attention. This process feeds on itself, resulting in the multibillion-dollar behemoths we see today. If you haven’t noticed, they’ve gotten really good at this. In 2020, Facebook generated $85.96 billion in revenue, with advertisements accounting for $84.2 billion of that total.

Unfortunately, Web2’s primary business model is to harvest our data and use it to sell ads back to us. This is not limited to Facebook and other social media platforms. To keep the lights on and the yachts afloat, Google, YouTube, Twitch, and countless other platforms rely heavily on data collection and advertising.

Advertisers have taken our place as customers on the internet. And we, as customers, have become the product. Advertisements are the lifeblood of the internet today.

On that note, let us return to GeoCities once more.

Handing Over Identity

The GeoCities population had exploded just before the turn of the century, making it the third most visited site on the internet. As previously stated, GeoCities was making money from digital ads, which were performing admirably. This all piqued Yahoo’s interest, and in January 1999, the company paid $3.57 billion for GeoCities.

Yahoo required GeoCities users to sign a new terms of service agreement shortly after the acquisition. According to the terms of the agreement, Yahoo would become the owner of all rights and content created on GeoCities. As one would expect, there was an immediate backlash from homesteaders. Yahoo quickly responded, claiming that the messaging had been misinterpreted. They added a few sentences to clarify their intentions, but the damage had already been done.

We can assume that Yahoo never intended to sell user-generated content directly, but that isn’t the point. What they did intend to do was profit from the platform’s users’ creations. While Yahoo may have bungled this handoff, businesses doing this work today have it down to a science.

These businesses, which control the majority of today’s web, are not looking to add value to their platforms’ users; rather, they are looking to extract it. As these platforms grow in size and influence, the network effect kicks in, making it increasingly difficult for users to leave.

You can’t just delete your Facebook account and transfer your followers, content, and clout to another platform. Your identity is fragmented and tied to the various websites you visit. And, as with domain names and digital content, the platform owns this identity, not you. It can be censored and confiscated.

You do not own your identity on the internet today.

The Mess of Web2

This is not about GeoCities’ shortcomings, Yahoo’s mismanagement, or Facebook’s greed. Sure, all of these things play a role here, but they were just the first dominoes in this complicated mess we’ve all gotten ourselves into.

The problem at hand is much bigger. Today’s web is controlled by a small number of companies and is based on an extraction system. This is not a basis for development, community, or creation. Tim Berners-vision Lee’s of giving away the internet’s source code for free is nowhere to be found. What was supposed to be an open and democratic platform for many has devolved into a highly centralized network controlled by a few.

Enough of the doom and gloom. We’re all aware of the holes in our ship. What happens next?

Web3, without further ado.

Web3 – Reshaping the Web

Web3 is an internet reclaiming movement.

It is a complete rethinking of how the web should work, not a single technology or advancement. Web3 is once again decentralizing the web and redistributing control and data ownership to its users. We are reclaiming our identities and reclaiming our freedom. Everything is being rethought.

This all begins with trust, which is a refreshing change of pace.

In Blockchain We Trust

When we look back at the problems that arose with Web1 and Web2, we see a common denominator: middlemen. Facebook serves as a bridge between communities. YouTube acts as a content distribution intermediary. The list goes on and on. This is nothing new; we’ve been using intermediary figures since before computers existed.

A middleman’s primary role in a given transaction is to facilitate trust. However, it is this reliance on intermediary figures that has resulted in the centralized ecosystem from which we are attempting to escape.

Web3 employs an ingenious solution known as blockchain to facilitate trust without the use of intermediaries.

Blockchain

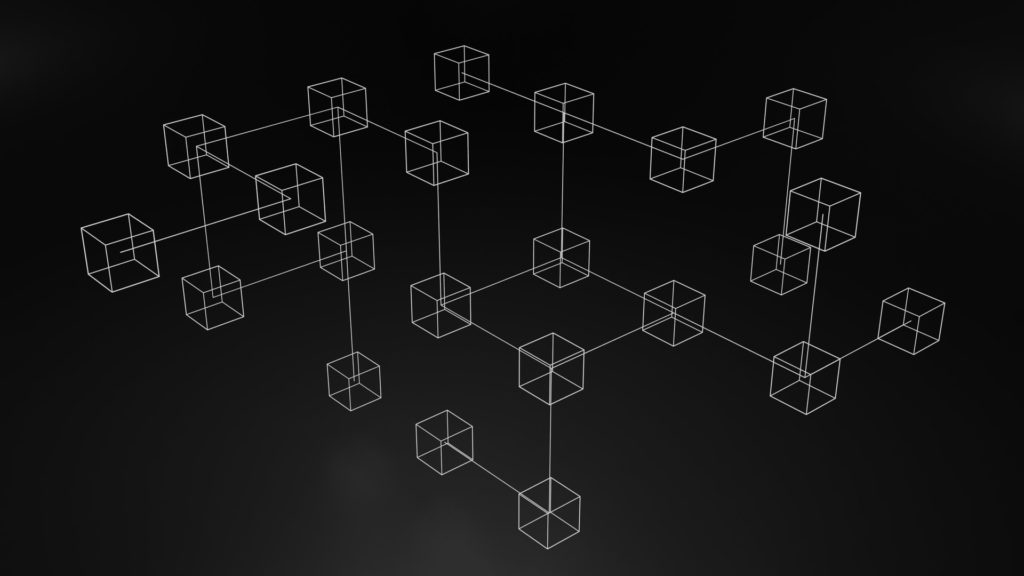

Blockchain is a distributed, decentralized, and immutable ledger. It is essentially a secure method of recording and tracking information without the use of a central authority. Blockchain is kind a big deal, so let’s break it down.

- Decentralized: Blockchain does not have a centralized owner or manager. It is instead managed and maintained by its entire user network. We can imagine this as a massive shared computer, with individual devices called nodes replacing Web2’s data centers and server farms. This eliminates a single point of failure as well as the possibility of a centralized figure gaining control of the network.

- Distributed: Because there is no single entity in charge of blockchain, users can add and verify transactions and information themselves. Blockchains are peer-to-peer networks that are governed by their users via a process known as consensus. There are various consensus mechanisms, such as proof of work and proof of stake, but they all have the same goal: to allow users of a blockchain to vote on transaction validity. This divides control over the blockchain and distributes it among its users, democratizing the network.

- Secure: Cryptography is at the heart of everything secure. In particular, blockchain employs asymmetric key cryptography for information encryption and decryption. Cryptography is…complicated. So, let us oversimplify. Assume you want to send me a briefcase full of documents via the good old-fashioned USPS. But those documents are confidential, and you don’t want anyone else to see them. Knowing that the briefcase will have to pass through several hands before it reaches me, you secure it with a combination lock that only I know the code to. You can now send the briefcase out into the world knowing that nobody but me will be able to read its contents. This is cryptography’s role in blockchain. The ability to protect information while making transactions public is what allows blockchains to be both public and secure at the same time.

The ability of blockchain to establish trust between individuals is critical in the world of Web3. Because trust is such an important component of Web3, it has been dubbed the “read-write-trust web.” Building trust into the web itself eliminates the need for intermediary figures and the dangers that they introduce into the ecosystem.

While democratization is wonderful, it also means that we, the users, become increasingly dependent on one another. So, how can we rely on blockchain users to keep the network healthy? The answer is built right into the blockchain: cryptocurrency.

Cryptocurrency – Aligning Incentives

Web3’s incentive mechanisms are based on cryptocurrencies. Instead of relying on advertisements to power everything (which worked well), cryptocurrencies can align the incentives of creators and users.

Instead of passively using a network that is funded by someone else, blockchain networks can directly reward users, giving them a compelling reason to support the network. Whereas Web2 chooses to extract value from its users, Web3 can redistribute value directly back to them through coins and tokens. Let’s see how this works.

Bitcoin demonstrated the power of blockchain by resurrecting the idea of a scalable, decentralized, peer-to-peer network from its Web1 grave. It’s worth noting that some peer-to-peer networks, such as Napster, existed before Bitcoin.

They were unable, however, to provide the same levels of security and decentralization to the network, nor did they incorporate an internet-native form of payment. Bitcoin has created a robust network that can operate entirely on its own by combining a secure P2P system with the ability to send and store value. There are no middlemen, centralized servers, or banks.

A Brief History

Satoshi Nakamoto invented Bitcoin in 2008. Satoshi’s name is a pseudonym, and no one knows his true identity to this day. On October 31, 2008, whoever Satoshi is, they published their whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System.” This now-famous whitepaper proposed a method for two parties to send payments to one another without the use of a centralized financial institution.

Satoshi mined the first Bitcoin block, known as the genesis block, on January 3, 2009. In that block, Satoshi also included the message “The Times Jan/03/2009 Chancellor on the verge of second bank bailout.” This headline from The New York Times implies that Bitcoin’s development was, at least in part, a reaction to the 2008 financial crisis. It was a solution to government and bank mismanagement of money.

Proof of Work

Because Bitcoin is a blockchain, its users are solely responsible for updating, protecting, maintaining, and storing the network. The network rewards users with its native coin, bitcoin, to incentivize them to do all of this work.

Digital Gold

Bitcoin has earned the moniker “digital gold” for being an extremely secure store of value. Still, it is somewhat limited in its capabilities, being used for little more than transferring and storing value. To be clear, this is intentional, as Bitcoin’s strict code is what makes it such a reliable store of value.

But what if you wanted to do something more complicated with the blockchain? This is where a smart contract platform, such as Ethereum, comes into play.

Ethereum

Ethereum, first proposed in 2013 by Vitalik Buterin, added functionality to the blockchain fundamentals established by Bitcoin. Whereas Bitcoin brought decentralization to money, Ethereum sought to extend it to applications. Vitalik and the Ethereum team created smart contracts to accomplish this.

Smart Contracts

A smart contract is a piece of self-executing code that is stored on the blockchain. Just as blockchain eliminates middlemen from the web, smart contracts eliminate middlemen from individual agreements and replace them with code.

A smart contract, once deployed to the blockchain, becomes part of the shared network and cannot be changed or edited by either party. This includes no tampering, canceling, or backing out. This eliminates the need for one party to trust the other because the smart contract will self-execute once the specified conditions are met. Smart contracts have numerous potential applications. They are, however, fairly simple at their core, operating on basic if-then statements.

Assume you wanted to send me some Ether, Ethereum’s native coin, in exchange for a new cryptocurrency I’m holding called EGG Coin. We immediately run into a problem. Do you send me Ether first and then trust that I’ll send you EGG Coin? Or should I send you some EGG Coin first and hope you’ll send me the Ether later? In any case, one of us will have to send our asset first and hope that the other person keeps their end of the bargain. If we’re good friends, this might not be an issue. But, if we are complete strangers (which we most likely are), there is no reason for us to trust each other. This is where a smart contract can help.

Instead of sending assets directly to each other, we send them to a smart contract. When the smart contract sees that it has received the specified amount of EGG Coin and ether from me, it will begin the payout. I receive your ether, and you receive my EGG Coin. What if I turn out to be a jerk and never send the EGG Coin? The smart contract will then simply return your ether to you with no further questions asked. All of this happens automatically, and because it’s on the blockchain, anyone can verify it.

Complete strangers can enter into risk-free agreements without the need for a third party by using a smart contract. Smart contracts are well suited to handle a wide range of transactions due to their open and tamper-proof nature. It is possible that in the future, we will use them for loans, mortgages, insurance, and even voting. Actually, some of this is already taking place, as we’ll see later.

Let’s take it a step further. After all, the web is far more complex than individual transactions. Ethereum’s goal is to enable anyone to program anything on the blockchain. While smart contracts can handle simple services such as trade facilitation, they can also power the backends of full-fledged applications.

Dapps

Web2 applications are typically stored and executed on centralized servers. Web3 handles this a little differently, as you might expect. Decentralized applications, or dapps, are open-source applications built with smart contracts and run on the blockchain.

Dapps effectively combine multiple smart contracts and add a user interface. As a result, a new world of applications emerges that appear familiar but provide the blockchain’s trustless, decentralized, and secure nature.

Dapps are not as vulnerable to hacking as their Web2 predecessors due to their decentralization. This is due to the fact that dapps, like everything else on the blockchain, are maintained by the entire network. There is no centralized server that stores dapp code.

In addition, there is no CEO or centralized company making decisions. A dapp is powered by the blockchain on which it runs and, as such, is owned and managed by the users of the blockchain.

Uniswap, a decentralized exchange (DEX) built on Ethereum, is one of the most popular dapps today. Users can use Uniswap to trade cryptocurrencies without the use of banks or intermediaries. Uniswap’s users, on the other hand, provide the exchange’s liquidity and govern the dapp themselves using Uniswap’s UNI token.

Reclaiming Identity

Have you noticed that we haven’t mentioned data yet? Where is it in Web3? It was a big deal in Web2.

It’s safe and secure in your wallet.

Wallets

Data is collected and sold to advertisers in the Web2 world to fund websites and applications. Fortunately, Web3’s cryptocurrency implementation has created a system in which this is no longer necessary.

Giving a dapp your name, phone number, date of birth, and other sensitive information is unnecessary because blockchain has built trust into the system itself. As a result, dapps do not require you to create an account with them in order to use their services. Instead, Web3 users access dapps through a wallet.

Your wallet is the means by which you interact with the blockchain. It is your gateway to the blockchain, storing your data as well as your cryptocurrencies and other digital assets. When you create a wallet, you generate a pair of cryptographic keys, one public and one private.

Your public key corresponds to your blockchain wallet address and can be distributed to anyone. Anyone can send coins, tokens, and other assets to your wallet using your public key. In contrast, your private key is used to gain access to the contents of your wallet. It is also used to sign transactions on the blockchain, proving that you own the wallet and its contents.

You should be very careful with your private keys, you shouldn’t share them to anyone. “Not your keys, not your coins,” says Web3. Anyone with your private key has the ability to steal or transfer the contents of your wallet, so keep it secure. A private key is similar to your bank’s PIN number or password. Someone who knows your password can log in and steal your funds.

While wallets take some getting used to, they are becoming more user-friendly by the day. One of their most intriguing features is that they collaborate with other dapps on the same blockchain network. Unlike Web2, you do not need to create multiple accounts and fragment your identity across multiple dapps.

On Web3, you simply select a dapp and connect your wallet. That’s all the information the dapp requires from you. This is similar to Web2’s single-sign on, where you can sign into other websites using your Facebook or Google account. However, using a Web3 wallet is far more secure because it is not linked to a data mine like a Facebook or Google account.

Data on Web3

We’ve gone over data ad nauseam at this point. The significance of maintaining control over your personal data cannot be overstated. As we’ve seen with Web2, giving companies our data effectively allows them to monetize us. One of the primary goals of Web3 is to eliminate this practice from the internet.

Web3 eliminates the need for personal data collection, as well as the possibility of abuse, through the use of cryptographic keys, wallets, and decentralized networks. This also eliminates the need for centralized data hubs. Hackers frequently target data hubs such as those owned by social media and ecommerce sites.

Why compromise one person’s account when you can compromise an entire warehouse full of them? Web3 is creating a safer, more user-focused web by developing systems that no longer collect sensitive data. It reclaims ownership of our data and puts us back in control of our identities.

Creating the Web We Want

We’ve covered a lot of ground now. Let’s take a step back and assess the situation.

We have decentralized networks with no middlemen. We have applications that are owned and operated by users. We no longer have to give up our data in order to use the internet. And we’ve reclaimed control over our digital identities.

As we peel back the layers of Web3, we see that it is a very different world than Web2. It is a place that rewards the user while also encouraging innovation. It welcomes everyone and challenges us all to build the web we want. Let’s look at what people are doing with Web3 now that we know how it works.

Reclaiming Ownership

NFTs and social tokens are two token types that we did not cover earlier. These are the pillars of Web3’s user-owned economies.

NFTs

Non-fungible tokens, or NFTs, are distinct assets that exist on the blockchain and have their own certificates of authenticity. Similar to barcodes, they are unique identifiers used to assign ownership of digital assets. Because NFTs are digitally unique, they cannot be exchanged for ether or dollar bills. They are also secure and immutable because they are stored on the blockchain.

The process of converting an asset into an NFT is known as minting. You add an NFT to the blockchain and sign it with your private key when you mint one. You can prove that you are the original creator by adding your digital signature to an NFT. This also demonstrates that you are the owner, granting you the authority to transfer or sell the NFT. As always, anyone can independently verify all of this.

NFTs have solved a long-standing problem for digital creators: how to introduce scarcity into digital assets. While another person could still copy and paste the file associated with an NFT, they would not be replicating its proof of ownership. That only exists in the owner’s wallet.

While digital art has received the majority of attention in this space, NFTs are not limited to images and videos. Books, video game assets, songs, and virtual pets can all be minted as NFTs.

Social & Creator Tokens

Web3 enables fans and investors to directly support creators via social and creator tokens. These are tokenized representations of an artist, brand, or community. This may appear a little….pretentious at first. However, these tokens hold the promise of allowing creators to profit from their work. This has become far more difficult than it should be over the years.

Web2 elevated the concept of social currency – the influence a brand or individual has over their network – to new heights. Social media provided us with influencers and self-proclaimed “gurus” who were able to capture large amounts of attention and build loyal followings. As we’ve seen, this attention is extremely valuable. However, as we have seen, converting this attention into monetary value is difficult. This is made more difficult when the platforms these creators use effectively own their content.

Creators have turned to crowdfunding platforms like Kickstarter and subscription services like Patreon to capture some of this value for themselves. This has enabled devoted fans to contribute to their favorite creators, but it still necessitates the use of intermediaries to facilitate the transactions.

Web3 removes social currency from the hands of platforms and returns it to the creators themselves by tokenizing creators and allowing fans to invest in them. Social tokens could be the key to freeing all types of creators from the constraints of centralized platforms.

Creator & Ownership Economies

When NFTs, social tokens, and their communities are combined, a revitalized version of the creator economy emerges. However, creators recognizing the worth of their work is only half of the equation. The game is no longer just about capturing value, in true Web3 fashion. It comes down to distributing value.

Artists such as 3LAU and RAC, entrepreneurs such as Alex Masmej, and curators such as WhaleShark have all issued their own creator tokens. Holders of these tokens are not only supporting the creators, but they are also riding along with them. Token holders of a creator, like shareholders of a company, receive a portion of the value they generate. They gain a stake in the creator’s body of work.

Creator tokens, which mimic blockchain’s ability to turn users into distributed workforces, provide fans with an additional incentive to support and promote their favorite artists because they now have their own skin in the game. Creators can even include perks like access to community groups, real-world events, and exclusive content in their tokens. This ability to fractionalize ownership and distribute wealth is still in its early stages, but it has the potential to create healthier, more accessible financial ecosystems.

Hopefully, creators will continue to prioritize giving back to their communities. If not, they risk becoming smaller versions of the centralized platforms from which they are attempting to escape.

You might be wondering how deep this rabbit hole goes at this point. This brings us to the cutting edge of Web3, where we are organizing all of these new technologies in exciting new ways. We’re also figuring out new ways to organize ourselves.

DAOs

Because of the open nature of blockchain, users from all over the world can band together to support a common cause. While creator tokens are one outcome, the same fundamental ideas can be used to build more complex systems. DAOs, or decentralized autonomous organizations, are the result of this.

DAOs are still in their infancy, and their mechanics may differ from one another. Take this high-level summary with a grain of salt.

DAOs are a new form of community organization that allows for collective ownership of a group’s assets and decision-making process. A DAO distributes governance among all of its members rather than concentrating control in a single person or small subset. DAOs also convert certain business elements, such as budget allocation, into code. Everything is stored on the blockchain as smart contracts, so everything is transparent and open for anyone to verify.

Members who join a DAO are given governance tokens. New members may also make cryptocurrency contributions to the DAO. All funds added are routed to a treasury, which is managed by a smart contract. Members can then use governance tokens to vote on how those treasury funds are spent.

The treasury cannot be spent or allocated without this voting process because it is managed by a smart contract. Voting also applies to other DAO decisions, such as how to carry out tasks and changes to its structure.

DAOs may use various methods of voting, voting power distribution, and other core practices. They all, however, have essentially the same goal: to form a group of people working toward a common goal and give them all a say in how the collective operates.

Metaverse and Beyond

Our final destination is the metaverse, which is located on the outskirts of Web3.

The metaverse is a collective digital space comprised of linked virtual worlds. This naturally conjures up images of immersive virtual reality inspired by Ready Player One, but let’s take it one step at a time.

Platforms such as Decentraland, Somnium Space, and The Sandbox enable users to meet up with friends, buy plots of land, and open shops and galleries all in a virtual space. This may sound similar to Roblox or World of Warcraft, but there are some significant differences.

Virtual Worlds, Real Economies

With the advent of cryptocurrencies and NFTs, it is now possible to transfer user-owned assets and their associated value from one digital space to another. Users of Decentraland exchange MANA, a cryptocurrency built on the Ethereum blockchain.

This use of cryptocurrency connects Decentraland’s “in-game” economy to our real-world economy. This also enables creators of in-game assets such as skins, accessories, and avatars to establish legitimate businesses based on virtual platforms. For the first time, digital spaces can access an economy beyond their own borders.

These virtual worlds’ shops and galleries are also inextricably linked to the real world. You can currently boot up Decentraland, enter the world with a virtual avatar, walk to an art gallery, and buy an NFT. It’s easy to see the parallels with purchasing something from a traditional website.

Users can freely move between these worlds because they all exist on the blockchain rather than in separate locked systems. This is what gives rise to the concept of the metaverse: a network of interconnected virtual worlds.

We are already used to communicating online via Facetime and Zoom, shopping on our phones, and searching the web for information. These interactions, and others, will be gradually digitized by the metaverse. From a virtual Travis Scott concert inside

Fortnite attended by millions to virtual reality business meetings in Somnium Space, it’s easy to see where this is all going. Digital worlds will continue to grow and become more immersive, as will the technology that supports them. We can anticipate the metaverse permeating more deeply into our lives.

Web3 is Here

The internet was designed to bring people together. That vision was lost somewhere along the way. The open and free internet was taken away from us. We surrendered our data, identities, and freedom. Worst of all? We didn’t even notice.

But we have a chance to change that. We’ve gone back to the drawing board, and everything is being reimagined. We, the users, are constructing a decentralized system that we will own and run. Where we have control over our data and identities We have the opportunity to build a web that is not bound by its current constraints.

We are regaining our freedom with Web3.

As we continue to expand this new frontier, it is critical that the Web3 ethos is not lost in the process.

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of EGG Finance. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中文 (中国)

中文 (中国) Русский

Русский Português

Português Deutsch

Deutsch