Table of Contents

You must read about whale behavior, comprehend it, and make reasonable comments about it if you want to become a skilled cryptocurrency investor.

Technical indications and price patterns are abundant when it comes to cryptocurrency trading, allowing you to take use of them to increase your profits. Among these popular crypto trading tools are support and resistance levels, bull flags, Bollinger bands, and moving averages.

Institutional investors frequently predict what everyone else is expected to do and take profits in advance when everyone is utilizing the same indicators, which is the problem. In other words, you need to do more than just simple technical analysis if you want to have an advantage over the institutions in the crypto market.

Utilizing on-chain analysis, which has whale movements as one of its most potent on-chain signals, is one of the simplest methods to accomplish this.

Few people are aware of how to use this signal successfully, therefore today I’m going to give you all the information you need to use whale movements to your advantage while minimizing suffering.

Cryptocurrency On Chain Analysis

You need to be familiar with the on-chain analysis to comprehend whale movements. Here is a fast crash course in that.

As you are likely aware, the majority of bitcoin blockchains are accessible to everyone. This implies that anyone may use a blockchain explorer to quickly view the majority of cryptocurrency transactions as they happen in real-time.

The wonderful thing is that you can do much more than just confirm whether or not your transaction went through when there is this level of openness.

Most Web3 blockchain explorers allow users to sort wallet addresses according to how much of a certain cryptocurrency or token they currently hold. Some websites, including etherscan.io, already do this. However, you must utilize their trackers if you use Binance Smart Chain or any other initiatives, like as Cosmos or Avalanche.

This can now show you if the quantity of that coin or token is fairly divided among its holders or whether it is concentrated in a small number of wallets.

There is a significant chance that one of the wallet holders could start selling, which would cause the price of that currency or token to plummet if the supply of a coin or token is significantly concentrated among a small number of wallets.

You may also use Web3 blockchain explorers to discover how individuals are using their cryptocurrency. Wallets from both controlled and decentralized exchanges will typically be identified by their labels by blockchain explorers. You can see from this whether or not people are holding or trading such currencies or tokens.

It’s likely that the holders of a cryptocurrency don’t intend to keep it for the long run if a sizable portion of its supply is held on exchanges.

If you see that the majority of the cryptocurrency supply is being traded often, it is likely that the holders of that cryptocurrency have no immediate plans to sell it. Now, some astute cryptocurrency traders have even gone so far as to locate the cryptocurrency wallets of wealthy individuals and institutions.

Whale Movements

A whale movement is a significant cryptocurrency transaction, to put it simply. Depending on the direction of the transaction, it’s a straightforward indication that can have a huge impact on the price of a cryptocurrency.

On a Web3 blockchain explorer, if you notice that a cryptocurrency is being transmitted from a regular wallet to an exchange wallet, it is likely that the sender wishes to sell the cryptocurrency.

When the transaction is little, this is not a huge concern. However, the price could drop if you witness the transfer of hundreds of millions of dollars’ worth of a cryptocurrency from a wallet to an exchange.

On the other hand, if you notice that a wallet is receiving hundreds of millions of dollars’ worth of bitcoin from an exchange, it is likely that the owner of that wallet has no plans to sell any time soon.

This abrupt decrease in market-ready supply can be the catalyst for a cryptocurrency’s price to rise if there are sufficient whale movements for that coin off of exchanges and into wallets.

When these two whale movements include stable coins, the results are reversed. The market may be set to pump if hundreds of millions of USDT or USDC are transferring from a wallet to an exchange, which indicates that whales are eager to buy.

If hundreds of millions of sable coins are not listed on exchanges, this indicates that the whales do not intend to make any investments soon, which could signal a brief decline or possibly a full-blown bear market.

If you’re curious what those whale movements from exchange to exchange are all about. Arbitrage is the response.

In other terms, a whale profits from a slight price difference between two exchanges. And due to their substantial resources, that minor difference gives a sizable return in terms of dollars.

Web3 wallet-to-wallet transfers are the final category of whale movement. These are most likely the least understood of the group. Unbelievably, few big investors use cryptocurrency exchanges. This is due to the possibility that the market might become agitated in the ways I just explained if they acquire or sell a significant amount of cryptocurrency.

Instead, they engage in over-the-counter (OTC) trading. OTC enables major investors to purchase or sell a significant volume of cryptocurrency at a set price directly from an exchange or crypto custodian.

It’s probably an OTC deal of some sort when you witness cryptocurrencies worth hundreds of millions of dollars moving between wallets.

The problem is that until after the event, you can never tell for sure if it was a purchase or a sale. This is why, up until they made it public, Tesla’s Bitcoin purchase had no impact on the price of BTC.

This means that while Web3 wallet-to-wallet whale moves normally have a small impact on price, you don’t need to pay too much attention to them.

What Counts As A Whale Movement?

Theoretically, all you need to know about whale movements is the transaction dynamics I just outlined, and some of you may be familiar with what I’ve said up to this point.

The problem is that average crypto traders frequently ignore certain aspects that can make whale movements into a false signal.

The definition is connected to the first factor. What size cryptocurrency transaction is required to be considered a “whale movement”? Depending on the whale tracking tool being used, the response varies. For instance, whale alert appears to tweet about every transaction on 13 blockchains that exceeds $1 million USD.

When determining how much of an effect a whale movement might have on the price of a cryptocurrency, this arbitrary threshold can be a major issue. This is a result of market saturation.

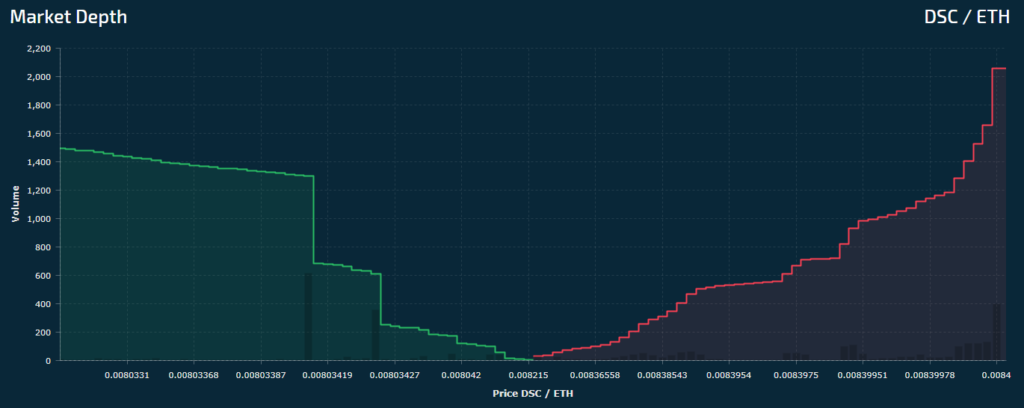

Market depth reveals how much capital is necessary to raise or lower a coin’s price on a specific cryptocurrency exchange. This may be quickly verified on Coin Market Cap or Coingecko under the markets tab. The market depth of a cryptocurrency is measured by how much money is required to move the price by 2% either up or down.

Here’s why it’s important: Even if all 10 million dollars’ worth of Bitcoin is sold right away, the impact on price would be minimal if it were to go from a wallet address to a crypto exchange with a market depth of 20-30M USD to the downside.

However, the majority of alternative currencies trade for millions of dollars or even less. This means that a whale movement of that size would completely empty the order books, decimating the price of that altcoin.

Furthermore, some cryptocurrency whale movements are so minute in terms of dollars that whale tracking technologies fail to even detect them. Even then, it might be sufficient to cause a price fall.

As a result, it’s crucial to consider the market depth for a cryptocurrency when estimating the impact a whale movement will actually have on its price. You should also avoid automatically assuming that the world is ending or that we’re going to the moon every time a whale alarm tweets.

Beyond Basic Whale Movements

Because most altcoins are heavily correlated to Bitcoin. Even if there wasn’t much whale activity, a Bitcoin whale movement may destroy your favorite alt taking place on that altcoins blockchain.

Additionally, as this bull market’s apex draws near, some whale trades will take on greater significance than others. Here’s what I mean, by that.

We observe a few dozen whale moves for cryptocurrencies like Bitcoin and Ethereum on any given day. These have a predictable impact on price and some of them are enormous and massive.

An old Bitcoin wallet making a transaction for the first time in a very long time is something you don’t see every day.

Transactions from these dormant Bitcoin wallets have the potential to significantly disrupt the market since they imply that prices have climbed to the point where even the most ardent hodlers are considering selling.

These ancient whale movements frequently make the crypto news, and whale trackers occasionally take note of them as well. Fortunately, most of these have recently been minor wallet-to-wallet transactions.

However, if we begin to approach that 100K or 200K level and you notice some of these old wallets begin to shift a significant amount of their Bitcoin onto exchanges, it may indicate that the price for this cycle has reached its peak or is very close to it.

Whale Movement Trading Psychology

The notion that smart money is aware of how the typical retail trader is likely to respond to particular whale movements is the third aspect that gets thrown out the window when evaluating whale movements.

When a lot of steady coins are produced, this is most obviously demonstrated. This fresh USDT supply should logically result in a Bitcoin pump. Actually, not quite.

Depending on market need, stable coins are created and destroyed. This is necessary because if there are too many or too few USDTs available compared to demand, the price of USDT could move away from its peg to the dollar in either direction.

The primary lesson to be learned from this is that price increases are not always a given when USDT or USDC are printed. It just indicates that there is more demand for certain stable coins.

After all, a large investor is unlikely to purchase Bitcoin by creating a large number of stable coins. Simply using an OTC desk will do.

However, the typical whale watcher ignores these data because they believe a massive pump is imminent because stable coins are being minted.

As a result, they are vulnerable to manipulation by large investors who might raise the price after the steady coin print by a few percentage points to create the appearance that anything is occurring.

Retail investors fall for the pump-and-dump scheme, and the smart money dumps them. When it comes to whale movements on and off exchanges, the same thing takes place. Reacting to the bare implications of these massive transactions is a wonderful way to get rekt by big investors since it leaves out the context of the first two criteria that I already highlighted.

Conclusion

I have had the luxury of thoroughly investigating on-chain analyses. I have experimented with both paid and free on-chain indicators and signals. You can obtain a good deal without having to put down a dollar, I can assure you of that.

The main distinction between the paid and free versions of the majority of on-chain metrics is that the latter are more sophisticated and give you more options for sorting through the data. What you learn about whale movements by using free resources like whale alert and browsing Bitcoin.com is essentially the same as what you get with Glassnode and Crypto Quant.

The quality of an indicator depends on the trader utilizing it, and it appears that the typical cryptocurrency trader doesn’t have much knowledge about whale movements or how to apply them.

We believe that this is due to the fact that there is no agreed-upon definition of what constitutes a “whale movement” in the cryptocurrency world. Any transaction that is significant enough to raise the price of a cryptocurrency is what I refer to as a “whale movement”; everything else is just background noise.

This notion also makes it simple to forget that whales and whale movements could not be related. That may sound unusual, but it serves to highlight how crucial it is to understand where wallet a whale transaction originates from.

After the crash in mid-May, I recall checking Vitalik’s wallet address and discovering that practically all of his Ethereum had vanished. It turns out that he simply transferred the majority of his ETH into cold storage, which was a minor panic.

Currently, I occasionally ponder whether these crypto billionaires have ever played chicken with the typical crypto investor by transferring sizable sums of cryptocurrency between exchanges without engaging in any transactions. They may even do this in conjunction with certain news or events if they anticipate that it will elicit strong reactions from the typical retail investor.

What I’ve learned from studying the Wyckoff approach is that you’re better off assuming that the clever money is constantly seeking for ways to play with your head. Make no mistake, keeping that in mind can help a lot. If you notice that hundreds of whale transactions are traveling to cryptocurrency exchanges simultaneously, it might actually be happening this time.

English

English Français

Français Español

Español Bahasa Indonesia

Bahasa Indonesia 中文 (中国)

中文 (中国) Русский

Русский Português

Português Deutsch

Deutsch